Chainlink Price Prediction: A Clear Path to $20 as Institutional Demand Explodes

Our latest Chainlink price prediction points to a powerful 40% surge toward the $20 milestone in the coming weeks. LINK is building formidable momentum, bolstered by a jaw-dropping institutional accumulation spree and bullish technical alignment. With the Grayscale spot ETF acting as a relentless buyer and the charts confirming a shift in structure, the stage is set for a significant breakout.

The $20 Target: Technicals and Sentiment Align

Chainlink is trading with conviction around $14.12, having established a clear pattern of higher lows—a classic sign of strengthening investor confidence. The technical roadmap is clear: a decisive move above immediate resistance could swiftly propel LINK toward $18, with the $20 level acting as the primary target. This represents a substantial 42% upside from current prices. The indicators support this bullish Chainlink price prediction: the MACD has crossed into positive territory, and the RSI holds steadily above 50, confirming underlying strength without being overbought.

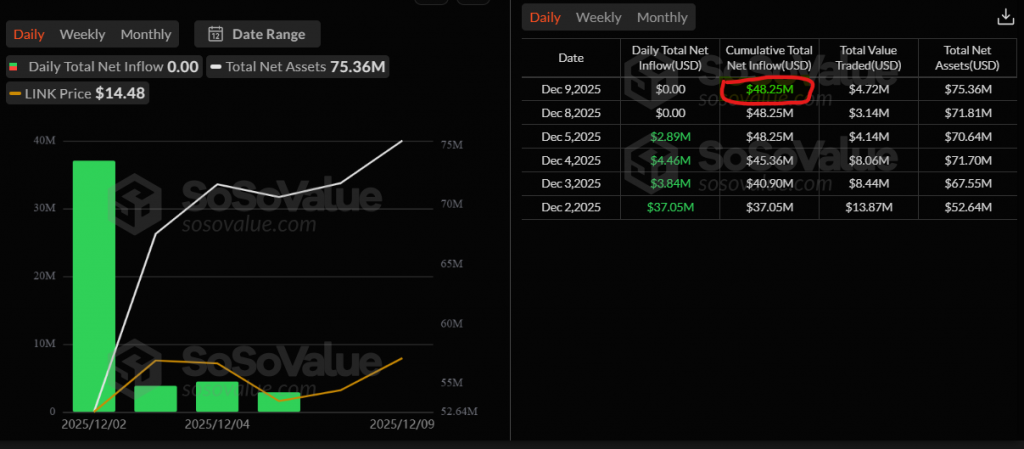

The Institutional Catalyst: Grayscale’s Massive Accumulation

The fundamental driver is undeniable. Grayscale’s spot LINK ETF has emerged as a monumental force, gobbling up a staggering 2 million LINK tokens in just one week. This isn’t passive investment; it’s aggressive, systematic accumulation that directly absorbs sell-side supply and creates a new baseline of demand. This ETF-fueled buying provides a structural tailwind that underpins the entire bullish thesis, transforming LINK from a speculative asset into a core institutional holding.

Market Context: Riding the Broader Wave

This move isn’t happening in isolation. Chainlink is advancing within a broadly bullish crypto market, with Bitcoin holding above $92,000 ahead of a pivotal FOMC decision and major altcoins like Ethereum and Solana posting strong gains. This “rising tide” environment provides the perfect backdrop for LINK’s specific catalysts to trigger an outsized move.

My Thoughts

The convergence here is exceptionally powerful. The Grayscale accumulation is a game-changer—it demonstrates that institutions aren’t just dipping a toe in; they are making LINK a strategic, long-term allocation. This fundamentally reduces circulating supply and creates a durable price floor. When combined with the constructive chart setup, the path of least resistance is decisively upward. If the broader market remains stable, LINK could lead the next phase of the altcoin rally, with the $20 target acting as a magnet.