Ethereum ETF Inflows Stay Positive Despite Short-Term Weakness

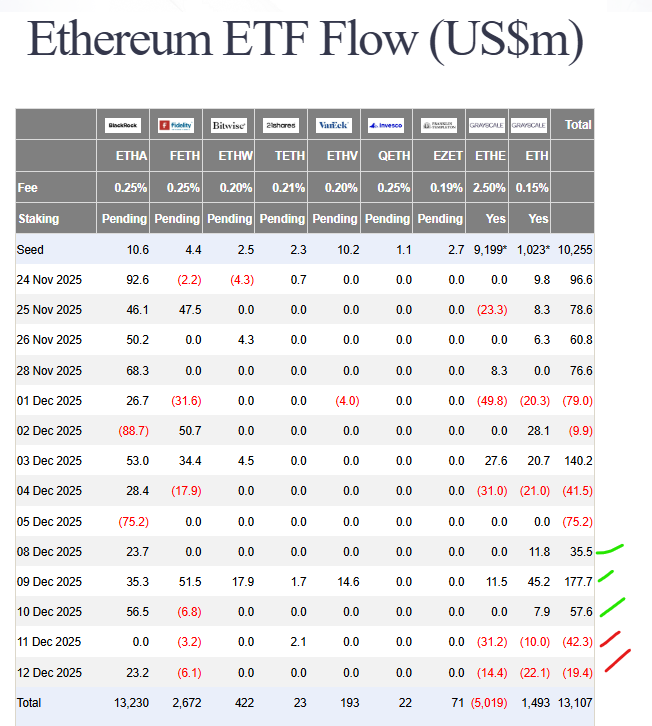

Despite recent market volatility, Ethereum ETF inflows remain firmly positive on a weekly basis. U.S. spot Ethereum ETFs recorded a weekly net inflow of $208.94 million, even as the market experienced two consecutive days of outflows and a notable price dip.

This divergence between price action and ETF flows highlights continued institutional interest in Ethereum.

Short-Term Outflows Do Not Break Weekly Momentum

On December 12, spot Ethereum ETFs posted a net outflow of $19.4 million, extending a short-term pullback in daily flows. However, these outflows were not enough to offset the strong inflows recorded earlier in the week, keeping overall weekly Ethereum ETF inflows in positive territory.

Ethereum ETF inflows Source : Farside Investors

Such behavior often suggests portfolio rebalancing rather than a loss of conviction.

Ethereum Price Holds Key $3,000 Support

Ethereum price saw a sharp pullback yesterday, falling from $3,269 to $3,038, before stabilizing near the $3,100 level. Despite the dip, ETH successfully defended the $3,000 psychological support, a key level watched by traders and long-term investors alike.

Earlier this week, ETH reached a high of $3,464, showing that bullish momentum has not fully faded.

Market Positioning and Sentiment

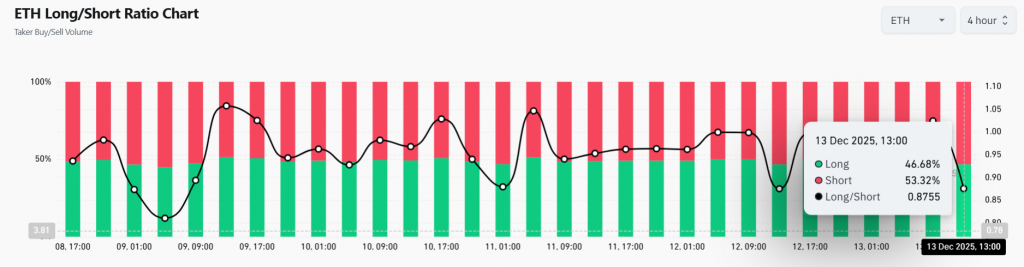

The ETH Long/Short ratio shifted slightly bearish following the price drop, with short positions rising to 53%, up from 49% the previous day. This increase reflects cautious short-term sentiment, though not extreme positioning.

From a technical perspective, Ethereum now faces a crucial resistance zone between $3,200 and $3,400. A successful reclaim of this range could open the door for renewed upside momentum.

Key Levels to Watch

- Support: $3,000

- Resistance: $3,200–$3,400

A clean breakout above resistance could reinforce bullish continuation, while a rejection may expose ETH to another test below $3,000.

Final Thoughts

Despite short-term volatility, Ethereum ETF inflows remain positive, signaling sustained institutional demand. As long as ETH holds above key support and ETF flows stay constructive, the broader trend remains intact — though reclaiming resistance will be critical for the next leg higher.