Solana Unleashed: RWA Tokenization Explodes to $873 Million

Move over, memecoins. Solana is now dominating a far more substantial market: real-world assets. The network just shattered its record, with total tokenized RWA value soaring to $873.3 million. This staggering Solana RWA growth, led by institutional giants, proves the blockchain is rapidly evolving into a core pillar of global finance.

This 10% monthly surge isn’t driven by retail speculation. Instead, it’s powered by heavyweight tokenized treasury products. Leading the charge are the BlackRock USD Institutional Digital Liquidity Fund ($255.4M) and the Ondo US Dollar Yield ($175.8M). Furthermore, tokenized stocks like Tesla and Nvidia are gaining real traction. With over 126,000 holders, Solana is on the cusp of becoming just the third chain to hold over $1 billion in RWAs.

What’s Driving This Massive Solana RWA Growth?

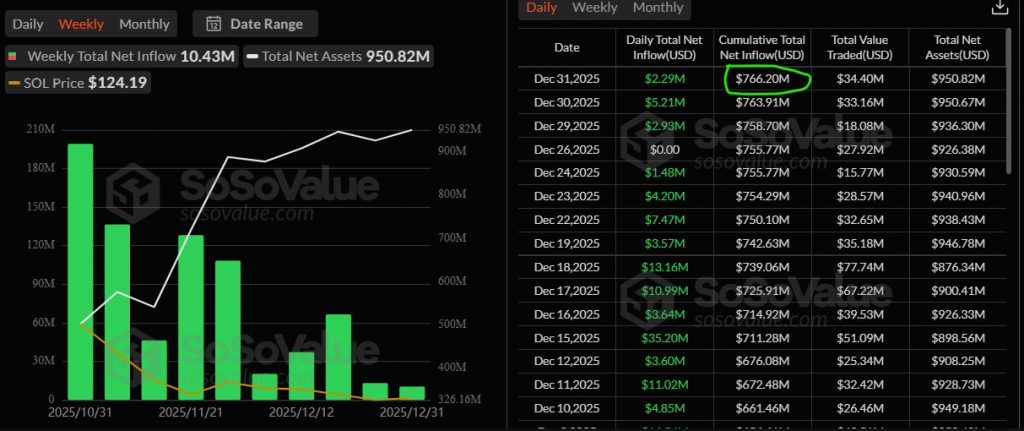

Three powerful engines are fueling this expansion. First, U.S. spot Solana ETFs have unlocked a massive institutional pipeline, attracting over $766 million in inflows since approval. Second, landmark partnerships, like Western Union building its stablecoin settlement platform on Solana, provide immense credibility and real-world utility set for 2026.

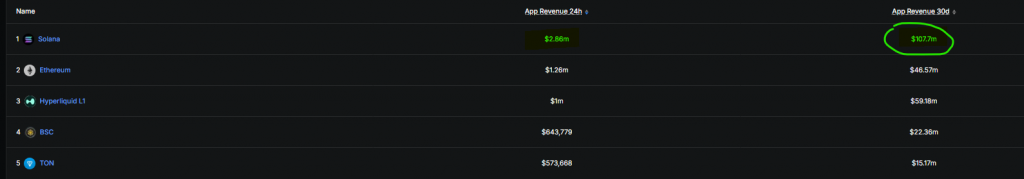

Finally, top analysts point to regulatory tailwinds. Firms like Bitwise predict that the potential passage of the U.S. CLARITY Act in 2026 could supercharge tokenization, with Solana positioned as a primary beneficiary. This fundamentals-driven growth is underscored by Solana’s leading $110 million in 30-day protocol revenue, dwarfing even Ethereum.

My Thoughts

This is a defining pivot for Solana. The network is demonstrating undeniable utility beyond speculation, capturing a foundational trend in finance. The combination of massive RWA growth, institutional capital via ETFs, and looming regulatory catalysts creates a profoundly bullish setup for 2026. While SOL’s price currently lags its ATH, these metrics suggest it is building a foundation for a sustainable, macro-driven bull run. The smart money is betting on infrastructure, not just hype.