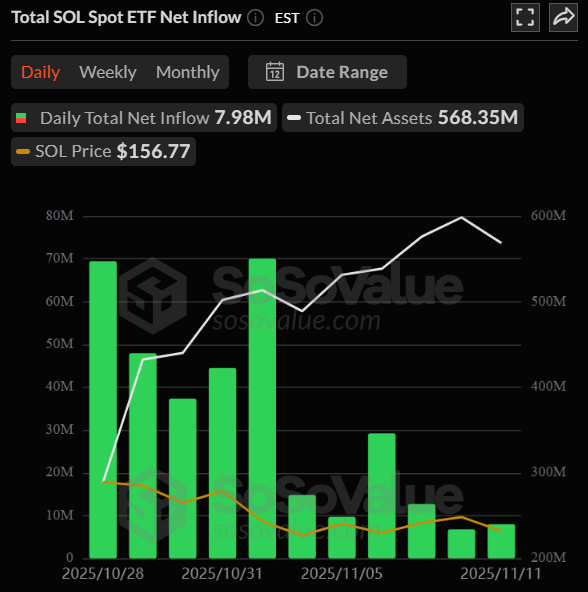

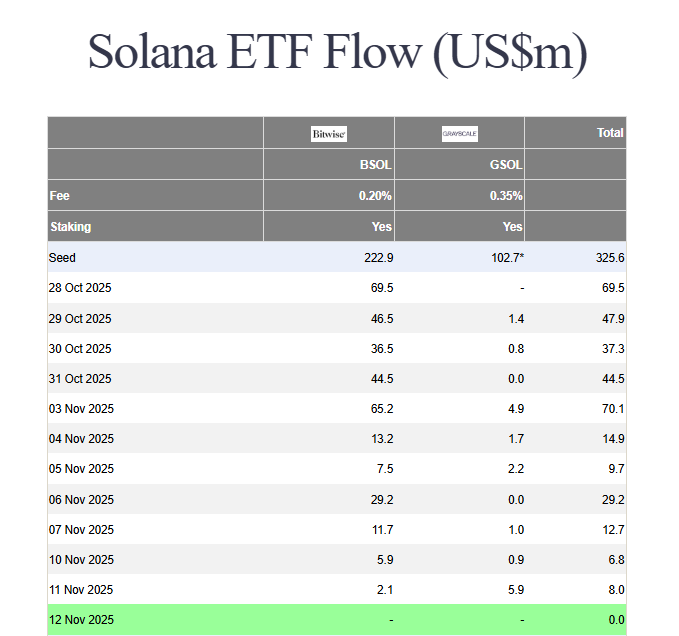

Even as crypto markets swayed and SOL price pulled back over recent sessions, Solana ETF inflows have shown remarkable persistence. On November 11, Solana ETFs recorded another positive day — the 11th straight day of net inflows since launch — adding $8.0 million to the funds’ coffers. That demonstrates steady institutional appetite for Solana exposure despite short-term price pressure.

Solana ETF inflows: daily snapshot

On Nov 11, the combined Solana funds took in $8.0M in net inflows. The breakdown shows the continued role of major institutional vehicles: Grayscale’s GSOL contributed $5.9M, while Bitwise’s BSOL added $2.1M. Keeping the inflow streak alive for an 11th consecutive day underscores that demand has not been a one-off launch phenomenon, but an ongoing allocation trend.

Price and market context

Today SOL trades around $153.55, down ~3.68% over the past 24 hours and pressured after two challenging weeks for the token. While prices have pulled back, the ETF flows suggest some investors — especially institutional managers — are viewing recent weakness as entry points rather than exit signals. That divergence between price action and flow data is notable: inflows signal confidence in the asset’s medium- to long-term story even as short-term volatility plays out.

Who is buying? Grayscale and Bitwise lead the way

The Nov 11 inflows were concentrated in two large custodial products:

- Grayscale (GSOL): $5.9M net inflow

- Bitwise (BSOL): $2.1M net inflow

The participation of these well-known issuers matters: it indicates diversified channel demand rather than concentration in a single vehicle. Institutional allocation through multiple trusted product wrappers tends to be stickier, which can support price foundations over time.

Why sustained Solana ETF inflows matter

- Structural demand: Repeated inflows create a consistent bid for SOL that can help absorb selling and reduce short-term downside.

- Institutional conviction: Multiple consecutive positive days — especially coming from established issuers — point to measured, strategic buying rather than speculative momentum chasing.

- On-chain and DeFi alignment: If ETF flows continue while Solana’s on-chain metrics (TVL, DEX volume) recover, the convergence of fundamentals and capital could accelerate a durable recovery.

Conclusion

Solana’s price may be under pressure in the short term, but Solana ETF inflows tell a different story: institutions continue to build exposure. The $8M added on Nov 11 — led by Grayscale and Bitwise — extended the ETF inflow streak to 11 days, signaling steady demand even amid market turbulence. For traders and longer-term allocators alike, that persistence in flows is an important data point to watch as SOL navigates its next leg of price action.