Major Solana treasury firms have demonstrated strong conviction by making significant discounted SOL purchases during recent market turbulence. Both SOL Strategies and Solmate Infrastructure announced substantial acquisitions from the Solana Foundation, capitalizing on the price dip to expand their holdings at attractive valuations.

Strategic Discounted SOL Purchases

SOL Strategies confirmed acquiring 88,433 SOL tokens using proceeds from its recently closed C$30 million LIFE offering. The transaction included approximately 79,000 locked SOL tokens purchased directly from the Solana Foundation at a 15% discount, complemented by open-market spot purchases. The Toronto-based firm’s interim CEO Michael Hubbard emphasized this “strategic deployment of capital” demonstrates their commitment to expanding their Solana treasury at attractive valuations.

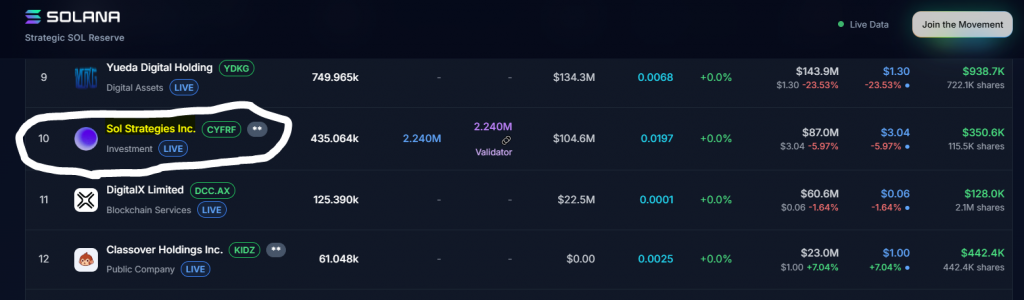

Following these discounted SOL purchases, SOL Strategies’ total holdings now reach 435,064 SOL, worth approximately $85.9 million. The locked tokens will fully unlock after twelve months and are immediately staked to the firm’s validators, generating ongoing yield while awaiting full liquidity.

Ark Invest Backs Solana Infrastructure

Meanwhile, Abu Dhabi-based Solmate Infrastructure executed its own $50 million discounted SOL purchases from the Solana Foundation, also securing a 15% discount during the volatile period. The strategic agreement includes provisions for the Solana Foundation to nominate up to two directors to Solmate’s Board, deepening the institutional relationship.

Notably, Cathie Wood’s Ark Invest has taken an 11.5% stake in Solmate Infrastructure, according to a Schedule 13G filing. Ark initially participated in Solmate’s oversubscribed PIPE financing, acquiring 6.5 million shares, and has since increased its position by nearly 780,000 shares. This represents the first-ever regulated US ETF investment into a crypto infrastructure PIPE.

My Thoughts

These strategic acquisitions demonstrate sophisticated institutional accumulation during weakness. The 15% discount provides an immediate margin of safety, while the staking generates yield during the unlock period. Ark’s participation validates the entire Solana corporate treasury thesis. This could establish a blueprint for how institutions accumulate major crypto positions during periods of market stress.