Bitcoin is charging toward its all-time high of $124,000, trading at $122,000 amid massive institutional demand. Analysts now suggest the market is entering a new Bitcoin accumulation phase, characterized by strong ETF inflows and reduced selling pressure from long-term holders.

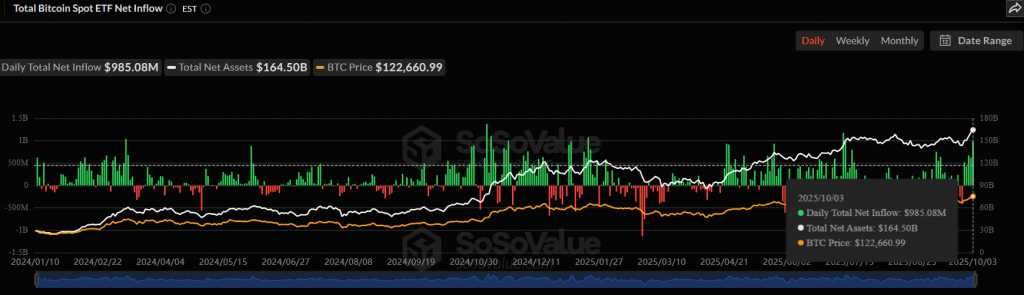

ETF Inflows Signal a New Bitcoin Accumulation Phase

The current Bitcoin accumulation phase is being driven by institutional capital. Specifically, spot Bitcoin ETFs recorded a massive $985 million in inflows on October 3rd alone, marking the fifth consecutive day of net positive flows.

Consequently, this consistent buying has absorbed previous selling pressure, unlocking the path for a retest of the record high. Swissblock analysts described the recent price dip as a “constructive reset,” indicating underlying strength rather than weakness.

On-Chain Data Confirms the Accumulation Trend

Key on-chain metrics support the Bitcoin accumulation phase thesis. For instance, the UTXO count has dropped to its lowest level since April 2024.

This decline suggests that coins are being consolidated and held by long-term investors, thereby reducing available sell-side pressure. Therefore, this maturation of the network is a classic hallmark of a sustained bull market.

Derivatives Market Shows Speculative Confidence

The Bitcoin accumulation phase is further validated by derivatives data. Open interest on Binance has hit a record $14.37 billion, confirming that new long positions are fueling the rally.

However, analysts caution that this high leverage introduces risk. If the price falls sharply, it could trigger significant liquidations. For now, the structure remains healthy, supported by strong spot demand.