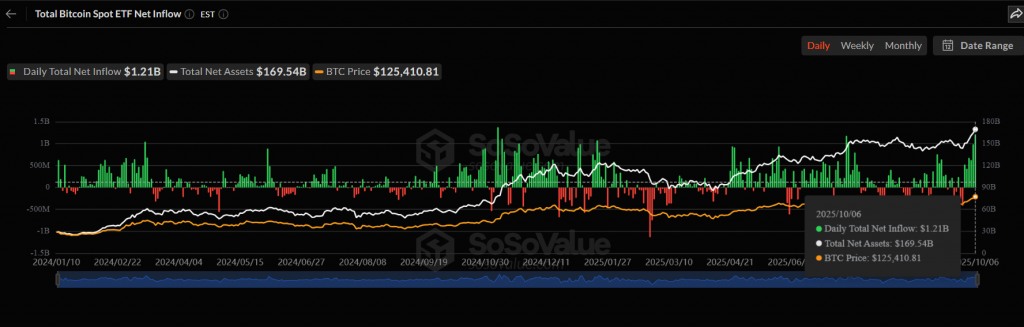

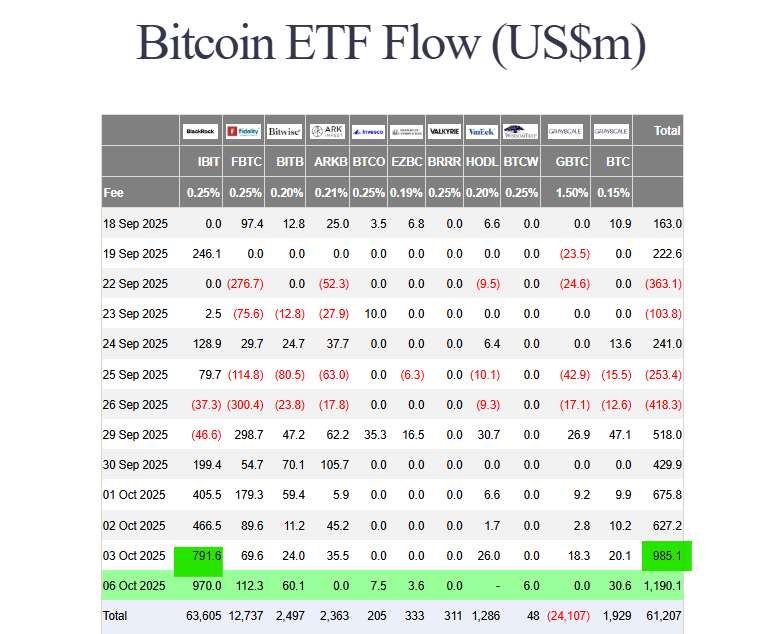

Institutional demand for Bitcoin has exploded, with Bitcoin ETF inflows reaching a massive $1.19 billion on October 6. This marks the second-highest single-day inflow since the funds launched, demonstrating powerful conviction as the BTC price holds firmly above $124,000.

Breaking Down the Massive Bitcoin ETF Inflows

The record Bitcoin ETF inflows were led by the industry giants. BlackRock’s IBIT dominated, attracting approximately $970 million alone.

Furthermore, Fidelity’s FBTC and Bitwise’s BITB contributed significant sums, bringing the total for a six-day inflow streak to over $4.43 billion. This sustained buying pressure highlights a major shift in institutional sentiment.

Price Action and Technical Context

The huge Bitcoin ETF inflows have provided strong support for the Bitcoin price, which recently hit a new all-time high of $126,198. Although the price has pulled back slightly, it continues to consolidate robustly above the $124,000 level.

Technically, the RSI is in overbought territory at 71.29, suggesting a potential pause. The next key resistance to watch is $125,000, a break above which could target $127,000.

The Bottom Line

The monumental Bitcoin ETF inflows confirm that institutions are aggressively accumulating Bitcoin. This creates a solid foundation for the market, with $122,000 now acting as a major support zone in any short-term correction.