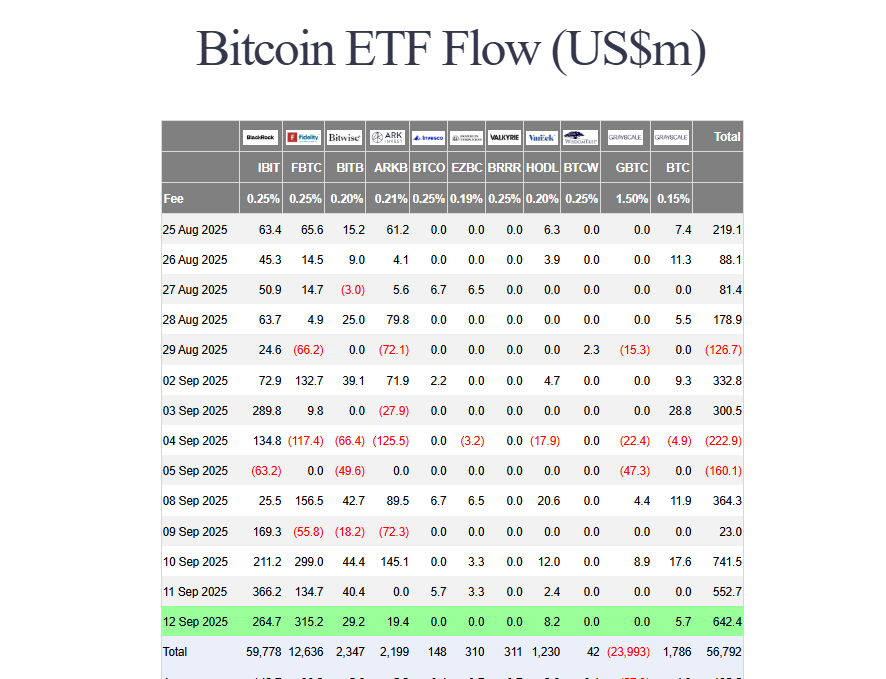

Institutional money is flooding back into Bitcoin. Spot Bitcoin ETF inflows surged to a massive $2.3 billion over the past week, with a single-day haul of $642 million on Friday, September 12. This powerful rebound signals that major players are positioning themselves ahead of a highly anticipated Federal Reserve interest rate cut next week.

Fidelity and BlackRock Lead the Charge

The week’s inflows were dominated by the two heavyweight issuers:

- Fidelity’s FBTC: Led the pack with a staggering $315 million in inflows on Friday.

- BlackRock’s IBIT: Followed closely with $264 million in new capital.

BlackRock’s fund also showcased its dominance in market activity, registering a colossal $3.2 billion in daily trading volume. The success has been so profound that BlackRock is now reportedly moving to tokenize its IBIT ETF, bridging traditional finance with the blockchain world.

The Fed Rate Cut Catalyst

The primary driver behind this institutional frenzy is the upcoming September FOMC meeting. The market is overwhelmingly betting on the Fed to kick off its easing cycle.

- Market Consensus: 105 of 107 economists surveyed by Reuters expect a 25 basis point cut.

- Future Outlook: Most project up to three rate reductions by the end of 2025.

Lower interest rates are historically bullish for non-yielding, risk-on assets like Bitcoin, as they reduce the opportunity cost of holding them.

Playing Catch-Up to Gold

Despite the strong inflows, Bitcoin ETFs are still trying to catch up to their traditional rival: Gold.

- Gold’s Performance: The precious metal is up a stunning 40% in the first eight months of the year.

- Gold ETFs: Have consistently attracted more capital as a hedge against macroeconomic uncertainty.

However, this week’s massive Bitcoin inflow surge suggests that institutional investors might be starting to rotate some exposure from gold to crypto, anticipating that BTC could play a similar safe-haven role in a looser monetary environment.

The Bottom Line

The return of massive inflows into Bitcoin ETFs is a strongly bullish signal. It shows that sophisticated institutions are not just betting on a Fed pivot, but are also recognizing Bitcoin’s evolving role as a macro asset. For the price to truly break out, BTC needs to conquer the $118,000 resistance level. If it does, this institutional fuel could be the catalyst for the next leg up in the bull market.