The Tide Has Turned: Bitcoin ETF Inflows Snap Outflow Streak!

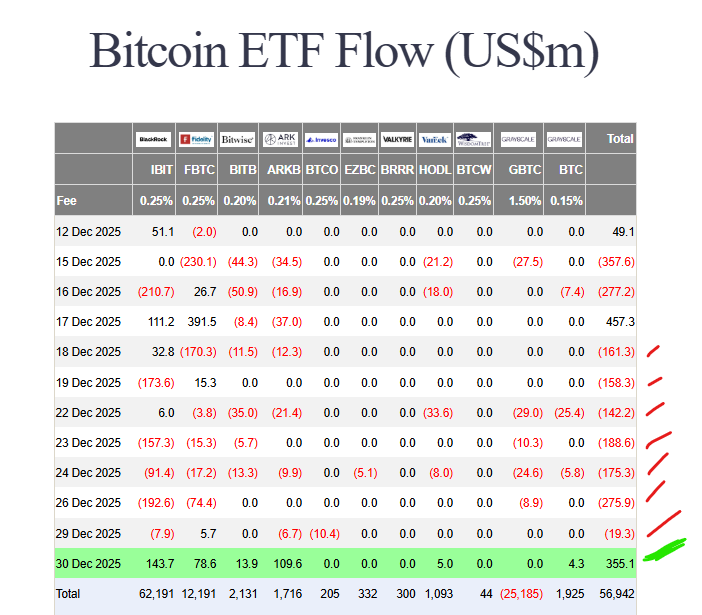

Hold onto your hats, because the institutional flow narrative just flipped bullish again! After a brutal seven-day stretch that saw over $1.12 billion exit, U.S. spot Bitcoin ETF inflows roared back with a massive $355 million single-day haul. This isn’t just a random blip, it’s a powerful signal that smart money is re-entering the arena, potentially marking a local bottom and the start of a fresh accumulation phase.

Leading the charge was BlackRock’s IBIT with a dominant $143.75 million inflow, showing their unwavering conviction. They weren’t alone; Ark’s ARKB and Fidelity’s FBTC piled on with $109.56 million and $78.59 million, respectively. Even Grayscale’s GBTC saw a slight inflow, which is a notable shift from its typical role as an outflow source. This broad-based buying suggests a coordinated move, not isolated action.

Why the Sudden Shift? Analysts Point to Global Liquidity

So, what’s the catalyst behind this dramatic reversal? Top analysts are pointing to a crucial macro pivot: improving global dollar liquidity. Legendary trader Arthur Hayes recently noted that liquidity likely bottomed in November and is now “inching higher.” This is monumental because crypto markets often act as a liquidity sponge.

When more dollars flow into the global system, risk assets like Bitcoin naturally benefit. Other commentators highlight “vertical” moves in money supply metrics and upcoming Fed Treasury injections. Simply put, the macroeconomic winds are shifting from a headwind to a tailwind, and institutions are positioning early.

Key Takeaways

- U.S. spot

Bitcoin ETF inflowstotaled $355M, decisively ending a 7-day, $1.12 billion outflow streak. - BlackRock (IBIT), Ark (ARKB), and Fidelity (FBTC) led the buying charge, indicating strong institutional demand.

- Analysts attribute the shift to improving global dollar liquidity, a major macro tailwind for crypto.

- Spot Ether ETFs also saw inflows ($67.8M), while spot XRP ETFs extended their inflow streak to 30 days.

My Thoughts

This is the alpha we’ve been waiting for. The reversal in ETF flows, coupled with the improving liquidity thesis, creates a potent bullish setup. It tells me that the institutional “sell button” has been lifted, at least temporarily. This often precedes a momentum shift across the entire crypto board. When the big players start buying the dip this aggressively, it’s time to pay close attention.