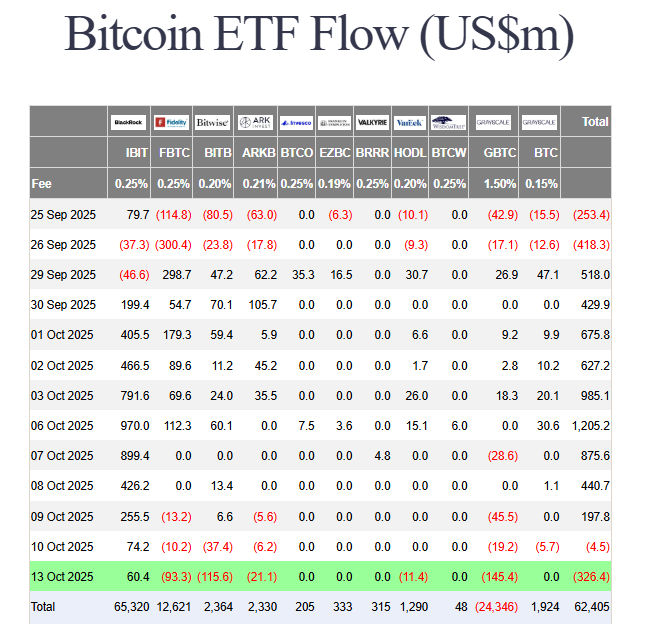

The Bitcoin market faces a surprising divergence as substantial Bitcoin ETF outflows contradict the ongoing price recovery. Despite BTC climbing back toward $115,000, spot Bitcoin ETFs witnessed a massive $326 million in net outflows on October 13. This significant institutional selling during a price rally suggests profit-taking is overwhelming new buying interest.

Major Bitcoin ETF Outflows Hit Market

Monday’s Bitcoin ETF outflows represent the largest withdrawal since the October 10 market crash. Nearly every major fund faced redemptions, except for one notable standout. BlackRock’s iShares Bitcoin Trust (IBIT) defied the trend by attracting $60.3 million in inflows. Furthermore, IBIT recorded a massive $4.7 billion in daily trading volume, demonstrating its dominant market position.

This outflow reversal follows an exceptionally strong start to October. Previously, Bitcoin ETFs had accumulated over $5 billion in net inflows during the month’s first week. However, former President Trump’s tariff announcement triggered renewed volatility, ultimately pushing weekly flows into negative territory.

Market Sentiment Shifts Toward Caution

The current price action reveals growing investor caution. Bitcoin currently trades near $112,636, down 1.6% with trading volume declining 23%. Additionally, on-chain data shows whales increasing short positions on major altcoins including XRP, DOGE, and PEPE.

BlackRock CEO Larry Fink amplified this cautious tone during a recent CBS interview. While acknowledging cryptocurrency’s role as a diversification tool “in the same way there is a role for gold,” he warned retail investors against making it a “large component” of their portfolios. This measured endorsement contrasts with his 2017 description of Bitcoin as primarily for “money launderers and thieves.”

My Thoughts

This divergence between price action and ETF flows is concerning. Typically, institutional inflows drive sustainable rallies. The current outflows suggest smart money is distributing to retail buyers during this bounce. While BlackRock’s continued inflows provide some comfort, the broader institutional hesitation could limit upside potential until macroeconomic uncertainties resolve.