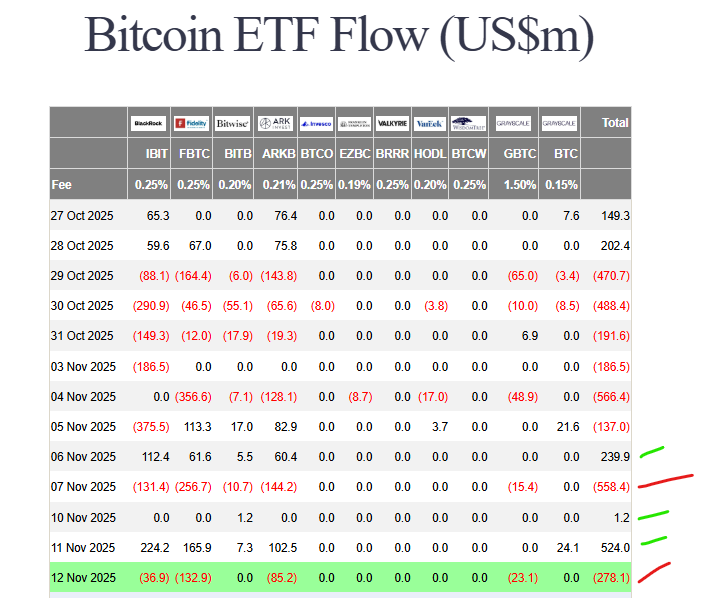

The institutional tide receded on Tuesday, but the story is more complex than it seems. Bitcoin spot ETFs recorded a significant $278 million in net Bitcoin ETF outflows on November 12.

Bitcoin ETF Outflows Hit $278M as Smart Money Rotates to Direct Holdings

The ETF outflows were recorded mainly by Fidelity’s FBTC and Ark’s ARKB leading the retreat with $133 million and $85 million in withdrawals, respectively. Despite this selling pressure, Bitcoin demonstrated remarkable resilience, defending the critical $100,000 support level. This divergence suggests that while some capital is leaving the ETF wrapper, underlying demand for Bitcoin itself remains robust, potentially setting the stage for the next powerful surge.

The Hidden Bullish Signal: A Rotation to Direct Ownership

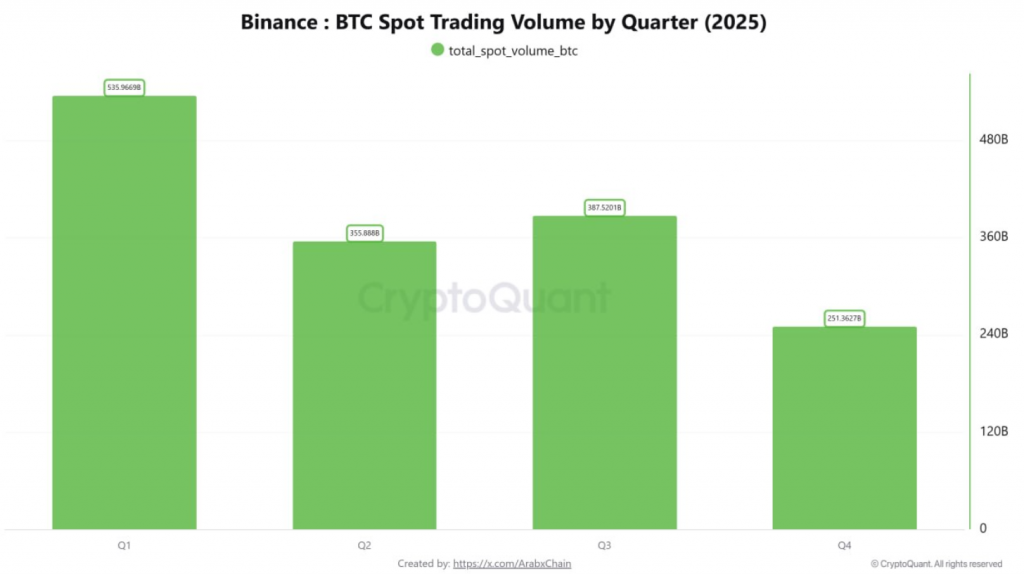

Here’s the alpha that the headline Bitcoin ETF outflows miss. While ETFs bled, CryptoQuant data reveals a massive surge in spot trading volume on Binance. The exchange has already processed a staggering $1.53 trillion in Bitcoin volume in 2025, with Q3 alone hitting $387.5 billion. This indicates that investors aren’t necessarily exiting Bitcoin; they are rotating from the ETF structure back into direct, self-custodied spot holdings. This could be a tactical move for greater flexibility or a response to the changing fee structures of the funds. It’s a shift in how people hold, not a loss of conviction.

Technical Crossroads: A Bearish Pattern or a Springboard to $112K?

The technical picture presents a critical battle. Analyst Ali Martinez warns of a potential head-and-shoulders pattern forming. In this scenario, a rebound to $112,000 would form the “right shoulder” before a rejection that could lead to a breakdown below $100,000, potentially targeting $83,000. However, this is not the only path. The same chart shows that a decisive break above the $112,000 level with strong volume would completely invalidate this bearish setup. Such a move could trigger a massive short squeeze and propel Bitcoin to become the “next crypto to explode” in 2025, as Martinez put it.

The Macro Tailwind: Government Shutdown Fears Fade

Adding to the potential for a bullish resolution is a clearing macro picture. The Senate has passed a stopgap funding bill, extending government operations and effectively ending the fears of a prolonged U.S. shutdown. This removes a major overhang of political uncertainty that has weighed on risk assets, including crypto. With this macro cloud lifting, the path is clearer for Bitcoin to resume its long-term trend based on its own meritorious drivers, like the upcoming halving and increasing adoption.

My Thoughts

This is a classic shakeout. The Bitcoin ETF outflows are likely a combination of short-term profit-taking and position rotation because the day before Bitcoin ETFs recorded a net inflows . The immense volume on Binance is the real story—it shows deep, liquid markets absorbing this ETF selling with ease. I’m viewing this consolidation as a healthy basing period. The defense of $100,000 is incredibly bullish. I believe the odds favor an upside resolution, with a powerful move toward $112,000 once this redistribution phase concludes.