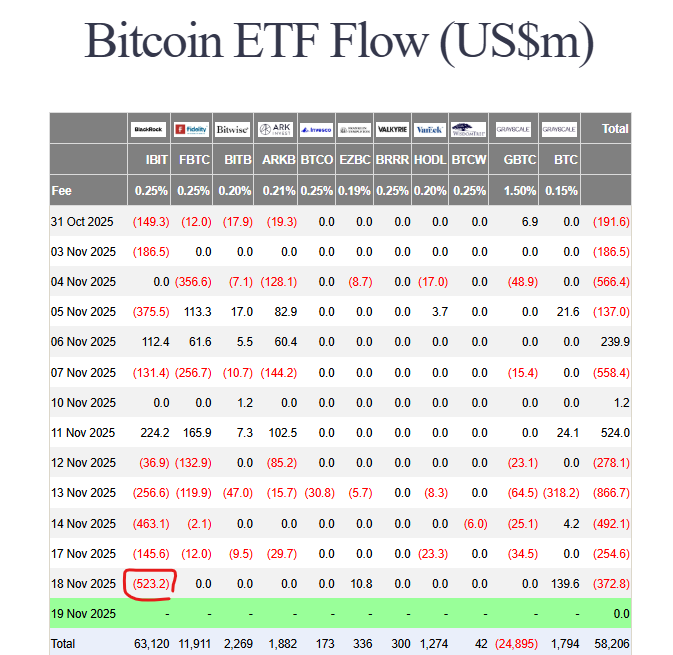

Bitcoin ETF Outflows Accelerate with $523M BlackRock Withdrawal

The institutional exodus from Bitcoin is reaching alarming levels. BlackRock’s iShares Bitcoin Trust (IBIT) just recorded a devastating $523 million in net outflows—its largest single-day withdrawal since launching in January 2024. This caps a brutal five-day streak where Bitcoin ETF outflows totaled a staggering $1.43 billion, contributing to four consecutive weeks of institutional selling. This relentless pressure has crushed BTC’s price, pushing it below $90,000 and extending its decline from October’s all-time high near $126,000.

Bitcoin ETF outflows Source : Farside InvestorsA Sovereign Contrarian Emerges

However, in a stunning contrast, a major sovereign wealth fund is betting big against the tide. Just before the market downturn, the Abu Dhabi Investment Council (ADIC) dramatically tripled its Bitcoin exposure. The fund acquired nearly 8 million shares of the very same IBIT ETF in Q3, a purchase worth approximately $518 million at the time. This bold move signals a profound divergence in strategy between short-term ETF traders and long-term sovereign investors. In a statement, an ADIC spokesperson compared Bitcoin to gold, affirming they view it as a crucial portfolio diversifier for the digital future and have no plans to back down.

What This Means for Bitcoin’s Future

This creates a fascinating market dynamic. On one hand, the relentless Bitcoin ETF outflows from Western institutions are creating significant selling pressure and fear. On the other, sovereign entities from oil-rich nations are accumulating with a multi-decade horizon. This isn’t just a trade for them; it’s a strategic allocation. The simultaneous selling by ETF investors and buying by sovereigns highlights a clash of time preferences and conviction levels. For retail investors, it’s a critical lesson: panic selling often happens alongside strategic, long-term accumulation.

My Thoughts

This is the clearest signal yet of a maturing market. While weak-handed ETF money flees, sovereign “strong hands” are establishing positions. Abu Dhabi’s move could inspire other sovereign funds to follow, creating a powerful, non-cyclical demand base for Bitcoin. The current Bitcoin ETF outflows are painful, but they are likely flushing out speculative capital and transferring ownership to more committed, long-term holders. This is ultimately bullish for Bitcoin’s foundation.