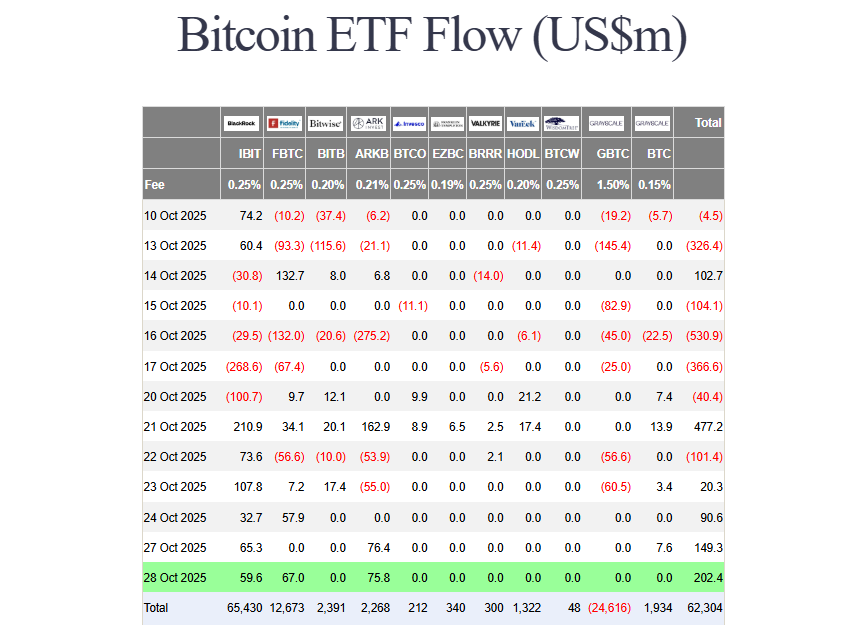

Get ready, because the institutional engines are firing back up. Bitcoin ETFs have just secured their fourth consecutive day of positive inflows, and the momentum is accelerating. On Tuesday, a massive $202.4 million poured in, marking a clear and powerful trend reversal. This surge in capital comes right after the market-shaking crash in early October, signaling that big money is confidently stepping back in.

Breaking Down the Stunning Bitcoin ETFs Inflows

Let’s dive into the data, because it tells a compelling story. The $202.4 million haul wasn’t just a random spike; it was led by the usual giants. ARK Invest spearheaded the charge with a $75.8 million buy-in, followed closely by Fidelity with $67 million and BlackRock adding $59.6 million. This consistent, multi-day buying spree from the world’s largest asset managers is the strongest possible signal. It shows they are accumulating BTC aggressively, clearly viewing current prices as a prime entry point post-dip.

Price Action Holding Firm Amid Accumulation

So, what is Bitcoin doing with all this new demand? Currently, BTC is trading around $113,060, showing a slight 0.7% dip in the last 24 hours. However, the bigger picture is far more bullish. The king coin is still up 4.5% on the week and is holding strong in a tight consolidation range between $107K and $116K. This price stability during heavy institutional accumulation is a classically bullish sign. It suggests the market is absorbing this new demand efficiently, building a solid base for the next leg up.

The Macro Catalyst Everyone Is Watching

Now, here is where the plot gets even thicker. All eyes are on a major macro event: a meeting between Donald Trump and China’s President Xi in South Korea. Trump teased the event on Truth Social, hinting at bringing “Trillions of Dollars” back to the USA. A potential trade breakthrough from this summit could ignite a massive wave of risk-on sentiment across global markets. Consequently, Bitcoin, as the leading risk-on asset, would be a primary beneficiary. Institutions are likely positioning for this exact scenario.

My Thoughts

This is a perfect bullish storm. The technical picture of rising ETF inflows combined with a potentially massive macro catalyst is a dream setup. Institutions aren’t waiting; they are front-running the news. This buying pressure, if sustained, could easily propel Bitcoin out of its consolidation range and toward new highs.