Bitcoin options traders are placing massively bullish bets ahead of today’s critical Federal Open Market Committee (FOMC) meeting. Despite broader market uncertainty, derivatives data reveals strong optimism for a rally toward $120,000.

Massive Bets on a Big Breakout

The sentiment among traders is extremely upbeat, driven by expectations of a 25 basis point interest rate cut from the Fed. This follows recent weak jobs data and signs of cooling inflation.

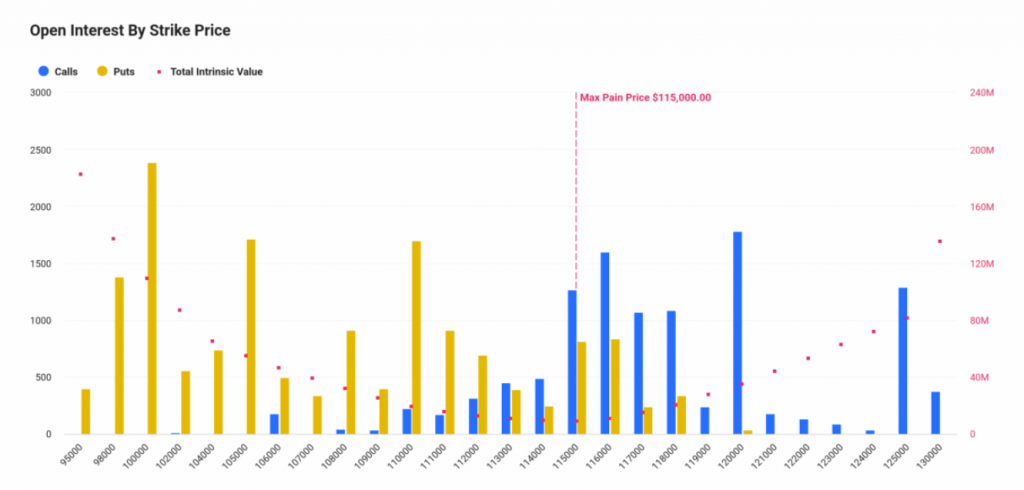

This optimism is clearly visible in the options market:

- The $120,000 strike price has call options with a notional value of $200 million for expiries over the next three days.

- Traders are also targeting $125,000 in an extremely bullish scenario.

- The put-call ratio sits at 0.68, indicating that call volume (bets on price increases) is significantly higher than put volume (bets on decreases).

Mixed Market Expectations

The entire market is holding its breath for the Fed’s decision and its accompanying economic projections. A rate cut could trigger a wave of bullish sentiment across global equities and crypto, fueling a major breakout for Bitcoin.

However, some analysts warn this could become a classic “sell the news” event, where the price falls after the anticipated news is finally released.

The CME FedWatch Tool shows high odds for three rate cuts this year. Research firm 10x Research notes that traders who were bearish just days ago are now flipping bullish, with “calls rich relative to puts.”

On-Chain Data Supports the Bull Case

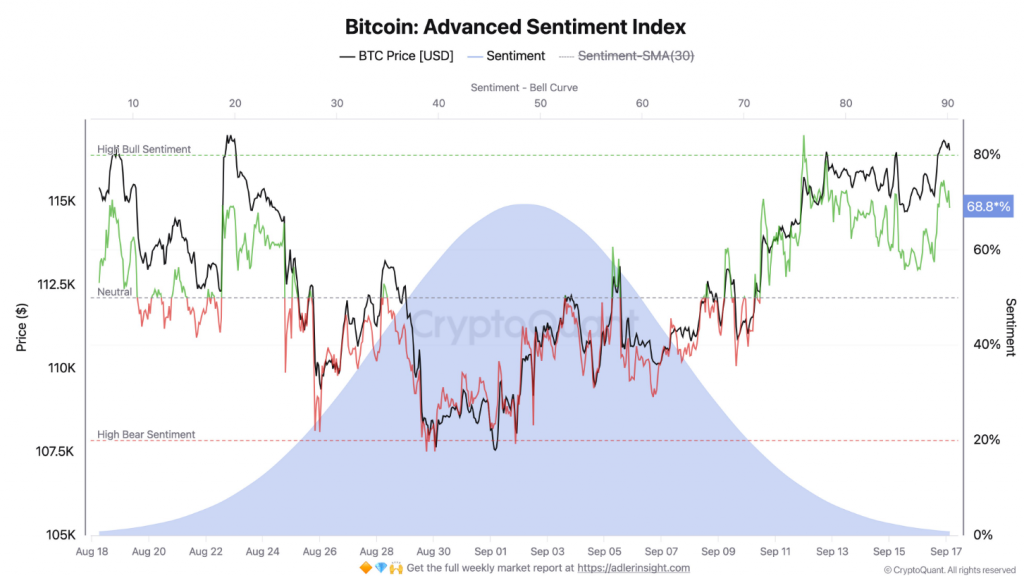

Key on-chain metrics reinforce this optimistic outlook. Bitcoin’s price is currently consolidating in a narrow range between $114.6K and $117.1K, holding in the upper third of this band.

Most importantly, the Bitcoin Advanced Sentiment Index is flashing a dominant bullish signal. It currently reads 68.8% and is approaching the “High Bull Sentiment” region near 80%.

This suggests the underlying market sentiment is very strong and poised for a breakout. A favorable outcome from the FOMC meeting could be the catalyst that triggers the next major leg up, potentially validating those massive options bets.