Bitcoin Price Consolidation Stuck in the Mud

Bitcoin is grinding through a classic Bitcoin price consolidation, trapped in a tightening range between $88K support and overhead resistance. The price action is telling: repeated tests of $88K are met with shallow, bought-up dips—a sign of absorption, not panic. However, each attempted rally lacks the follow-through to break the pattern. With momentum cooling and volatility compressing, this energy is coiling for a significant directional move once the range finally breaks.

The Dual Narrative: Technical Indecision Meets ETF Outflows

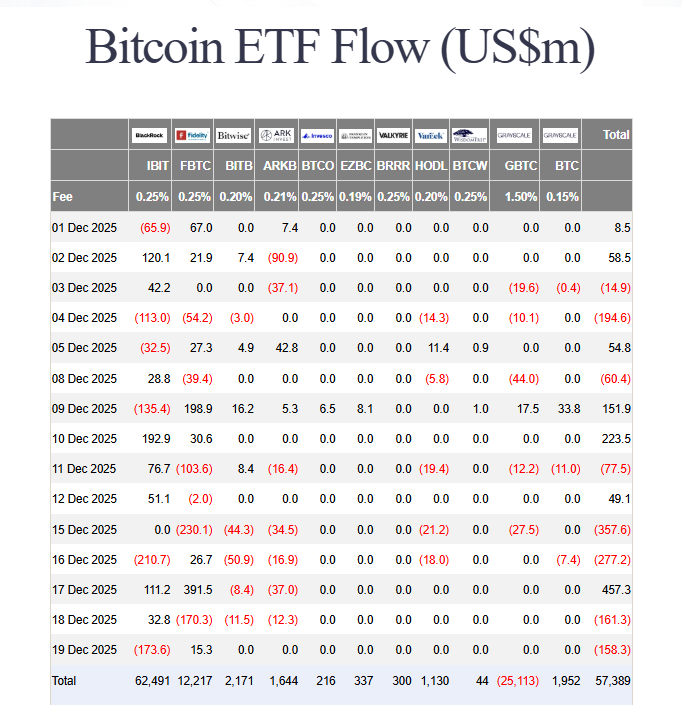

The technical picture shows a market at an impasse. On the daily chart, Bitcoin remains in a corrective phase, forming lower highs since its rejection from the $93K peak. This isn’t panic selling; it’s a redistribution. However, the fundamental backdrop adds pressure. Spot Bitcoin ETFs recorded a second consecutive daily net outflow on December 19th, shedding another $158.3 million, led by BlackRock’s IBIT. This brings the weekly outflow to nearly half a billion dollars, confirming that institutional buying momentum has stalled for now.

This combination—technical compression and wening ETF demand—creates the current stalemate. The market is searching for a catalyst to tip the scales.

Three Trading Scenarios for the Next Move

The resolution of this Bitcoin price consolidation presents three clear paths:

- Range Trade (Neutral/Bullish): Buy the dip between $88K–$85.5K, targeting a bounce to $89.8K–$92K. Stop loss below $84.8K.

- Breakout Trade (Bullish): Enter on a confirmed break and hold above $90K, targeting $92.5K and then $96K. Invalidation is a return below $88.8K.

- Breakdown Trade (Bearish): A daily close below $88K opens the path to $85.4K and potentially $80K. This scenario is invalidated by a reclaim above $89K.

My Thoughts

This is a trader’s market, not an investor’s. The Bitcoin price consolidation is a battle of attrition. The ETF outflow data is concerning but reflects short-term profit-taking, not a structural abandonment. My bias leans toward a final shakeout. The most painful move for the majority would be a breakdown below $88K to flush out weak hands and test the $85K area before a stronger reversal. However, patience is paramount. Wait for the range to resolve with conviction before committing significant capital. The next big move is coming.