Bitcoin Price Prediction: Stuck in a $92K-$85K Range Until FOMC Clarity

Our latest Bitcoin price prediction aligns with a growing analyst consensus: expect sideways action until the Federal Reserve speaks. Respected analyst Michael van de Poppe forecasts Bitcoin will remain rangebound, trapped between roughly $92,000 and $85,000 until after Tuesday’s pivotal FOMC meeting. This cautious stall reflects a market in wait-and-see mode, where macro policy will dictate the next major move.

The Macro Overhang: All Eyes on the Fed

The primary driver of this consolidation is clear: macroeconomic uncertainty. Van de Poppe notes that investors are acting conservatively, lacking the confidence to push for a breakout ahead of the Fed’s policy signals. The market’s reaction will hinge on the tone of the FOMC statement. A dovish shift could reignite risk appetite and propel Bitcoin upward, while a hawkish or cautious stance could extend the consolidation or trigger a test of lower support. History shows Bitcoin can react violently to these cues, as seen when it surged past $90k following the recent end of Quantitative Tightening (QT).

A Silent Accumulation: Mid-Size Holders Buy the Dip

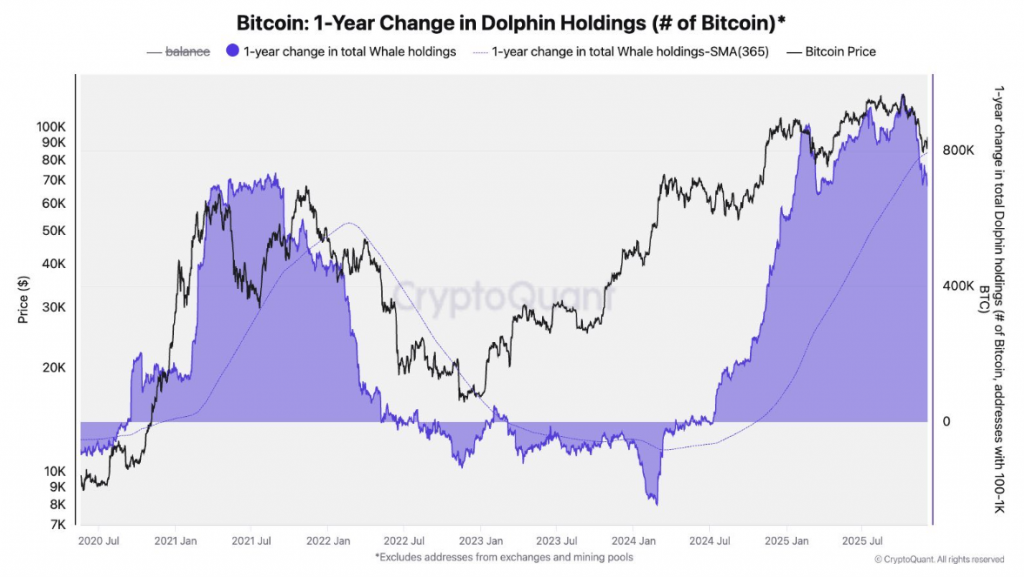

Beneath the quiet price surface, a critical trend is unfolding. On-chain data from CryptoQuant reveals that mid-size holders (addresses holding 100 to 1,000 BTC) are accumulating aggressively. The one-year change in their holdings is rising sharply, indicating this cohort is buying the current consolidation. This “smart money” segment often accumulates before major sentiment shifts, suggesting underlying confidence in Bitcoin’s long-term strength despite short-term macro fears. Their actions provide a bullish counter-narrative to the prevailing market anxiety.

Market Sentiment Reflects the Standstill

Current price action mirrors the broader caution. Bitcoin is trading in a tight band near $89,500, with minimal momentum across key timeframes. The Crypto Fear & Greed Index has sunk to 23 (Extreme Fear), a level typical during periods of weak confidence and pre-major news events. This pervasive fear explains the lack of retail-driven volatility and underscores why a catalyst like the FOMC is needed to break the stalemate.

My Thoughts

This is a classic compression before an expansion. The aggressive accumulation by mid-size holders is the most telling data point—it shows informed investors are using the fear and uncertainty to build positions. While the Bitcoin price prediction for the immediate term is neutral, the setup post-FOMC is primed for volatility. A dovish lean could trigger a fierce short squeeze and a rapid reclaim of $94K. However, should the Fed disappoint, a flush toward $85K is likely before these mid-size buyers step in even more aggressively. The quiet won’t last.