The Bitcoin price rebounds strongly today, climbing back above the crucial $123,000 level. This recovery follows a significant 24-hour dip, demonstrating the market’s continued resilience. Interestingly, the surge appears directly tied to Federal Reserve Chair Jerome Powell’s latest comments—or rather, his lack thereof.

Powell’s Silence Sparks Rally

Earlier today, Powell delivered welcome remarks at a banking conference while carefully avoiding any mention of monetary policy. Consequently, market participants interpreted this silence as a positive signal. Previously, traders had feared hawkish commentary that might delay anticipated rate cuts. Therefore, the absence of such rhetoric allowed bullish sentiment to return, helping the Bitcoin price rebounds from its intraday low near $122,000.

Meanwhile, delayed economic data continues to create uncertainty. Specifically, the weekly jobless claims report was postponed due to the ongoing U.S. government shutdown. This lack of fresh economic indicators leaves markets closely parsing every word from Fed officials for policy clues.

Rate Cut Expectations Fuel Bitcoin Price Rebounds

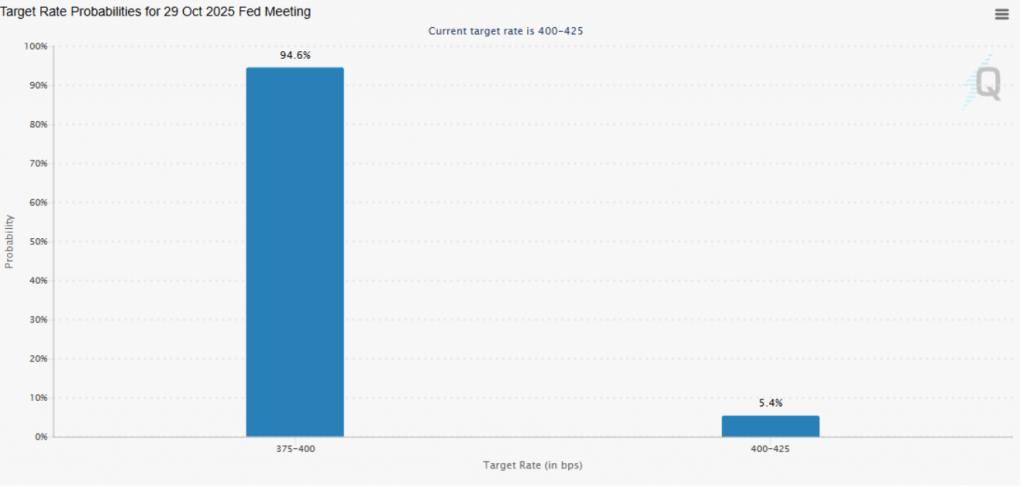

The broader macroeconomic backdrop remains highly supportive. Recently released FOMC minutes revealed that most officials support additional rate cuts this year. Accordingly, CME FedWatch data now shows a 94.6% probability of a 25-basis-point cut at the October 29 meeting. Furthermore, markets currently price in another cut for December.

These dovish expectations have already powered Bitcoin’s impressive 7% monthly gain. Additionally, they helped push BTC to its recent all-time high above $126,000. Today’s price action suggests the market quickly buys any dip when the fundamental outlook remains unchanged.

My Thoughts

This rebound demonstrates strong underlying demand. Essentially, the market treated Powell’s silence as permission to continue buying. However, traders should remain cautious as three other Fed officials speak later today. Any unexpectedly hawkish comments could test this recovery. Nevertheless, the dominant rate-cut narrative continues supporting higher prices.