Bitcoin made a comeback towards the $64,000 mark on Thursday, instilling confidence that the leading cryptocurrency could soon break its previous record high. However, before reaching that milestone, traders might encounter a pause.

The token surged by as much as 5.12% to $63,649 by 9:30 a.m. in New York, swiftly rebounding after enduring a volatile trading session the previous day. Wednesday saw Bitcoin spiking to $63,968 before witnessing a crash back below $59,000, causing disruptions for crypto providers like Coinbase Global Inc., which struggled with outages amid increased traffic.

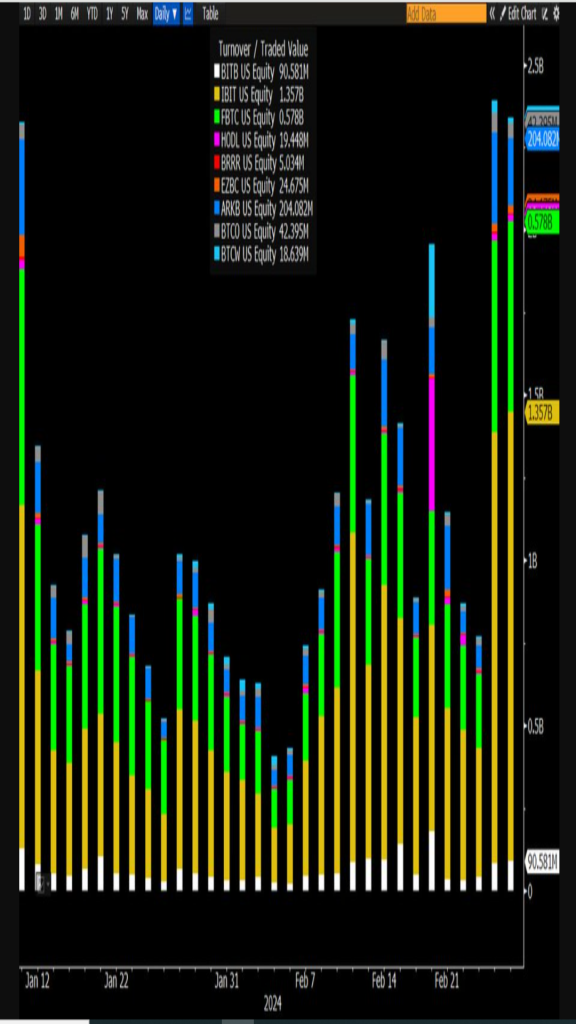

The surge in buying activity has been driven primarily by substantial net inflows into US Bitcoin exchange-traded funds, exceeding $7 billion this week. This momentum has drawn parallels to the environment preceding Bitcoin’s all-time high of nearly $69,000 in November 2021, sparking discussions about whether this rally signals the onset of a new bull market for cryptocurrencies.

A key concern has been the limited supply of Bitcoin available for purchase in the open market, with over half of all Bitcoin tokens in circulation remaining dormant for more than two years, as per Glassnode data. However, some experts, like Stephane Ouellette, CEO of digital-asset platform FRNT Financial, suggest that fears of a liquidity crisis may be exaggerated, as short-term holders have begun offloading positions.*

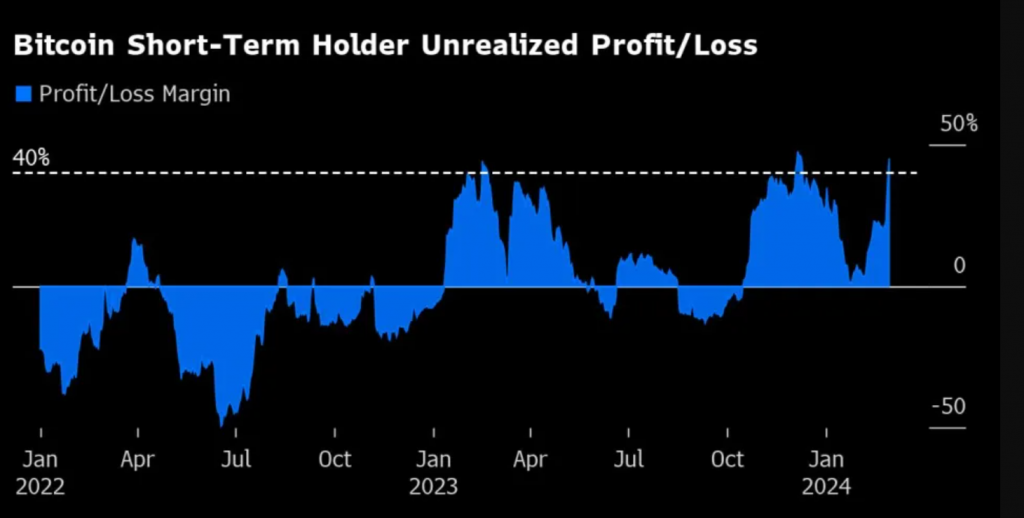

Nevertheless, there’s a possibility of a momentum slowdown. Data from CryptoQuant reveals that the unrealized profit margin of short-term Bitcoin holders, typically active traders rather than long-term investors, has reached extreme levels after the recent rally. With margins currently hovering around 45%, any figure above 40% indicates a potential price correction.

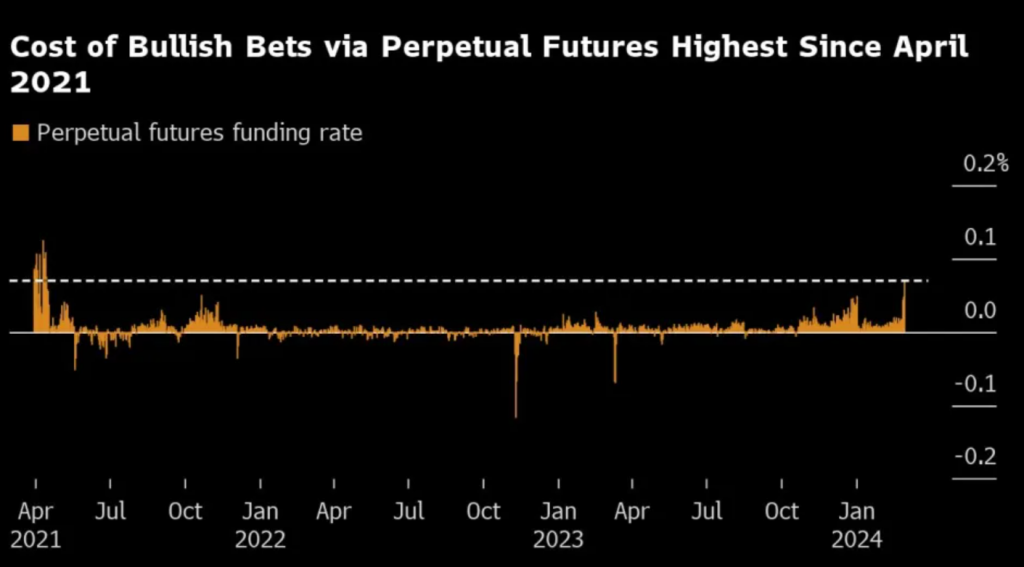

Furthermore, Bitcoin’s recent rally has led to exorbitant costs for opening new long positions in the token’s perpetual futures market, indicating a possible slowdown. The funding rate for Bitcoin perpetual futures is at its highest level since April 2021, suggesting that high costs for new long positions often precede a price pause or correction, according to CryptoQuant.