Nasdaq Proposes Major Boost for Bitcoin ETF Options Trading

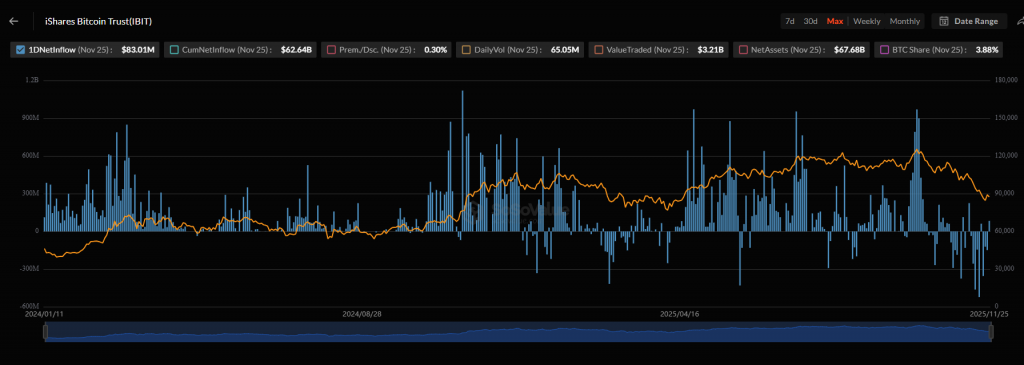

In a powerful endorsement of Bitcoin’s institutional maturity, Nasdaq has filed to dramatically increase position limits for BlackRock’s iShares Bitcoin Trust (IBIT) options. This pivotal move would reclassify IBIT into the same elite category as the world’s most liquid equities and ETFs, effectively treating Bitcoin as a mainstream asset class. The proposal seeks to raise the contract limit from 250,000 to 1.5 million, a 500% increase that would provide institutional players with the necessary runway to deploy serious capital into Bitcoin ETF options.

Unlocking Advanced Institutional Strategies

This isn’t just a technical update; it’s a game-changer for institutional trading strategies. The current cap has been a major bottleneck. As Jeff Park, Head of Alpha Strategies at Bitwise, previously argued, the 25,000-contract limit was far too restrictive for a market of this size. The new limit allows large firms to execute sophisticated options strategies like “call overwriting” (selling call options against holdings for yield) with proper scale. For volatility sellers, this means better hedging capabilities, which could ultimately reduce market volatility. Conversely, the enhanced liquidity might also attract more speculative capital, potentially increasing sharp price movements.

A Watershed Moment for Bitcoin’s Financial Integration

Bloomberg’s senior ETF analyst Eric Balchunas highlighted the significance, noting that IBIT already has the largest Bitcoin ETF options market by open interest. This regulatory shift signals that traditional finance is adapting to crypto’s growth, not the other way around. The filing explicitly acknowledges Bitcoin’s expanding liquidity and market cap, stating the change is necessary to reflect its importance in financial markets. This move marks a clear evolution from the initial adoption of spot Bitcoin ETFs to the development of a mature, robust derivatives ecosystem around them—a critical step for long-term institutional participation.

My Thoughts

This is the structural upgrade Bitcoin needs for its next leg up. By legitimizing and expanding the Bitcoin ETF options market, Nasdaq is laying the groundwork for billions in additional institutional capital. This isn’t just about more trading—it’s about better, more efficient trading. Options markets provide crucial price discovery and risk management tools that large asset managers require. This development could be the catalyst that pushes Bitcoin into a new volatility regime, attracting both yield seekers and speculators in equal measure.