Broad Crypto Market Rally Kicks Off Ahead of Pivotal Fed Meeting

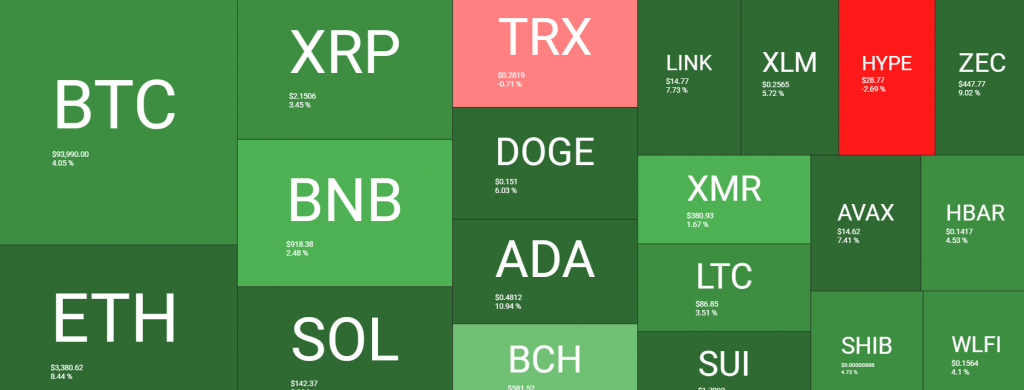

A decisive crypto market rally is sweeping across major assets today as traders position ahead of tomorrow’s highly anticipated Federal Reserve decision. Bitcoin has surged 4% to touch $94,000, leading a charge that has lifted Ethereum, XRP, and Solana by 6-8% and pushed total market capitalization back above $3.2 trillion. This coordinated move reflects growing confidence that the Fed will deliver its third rate cut of the year, injecting fresh liquidity into risk assets.

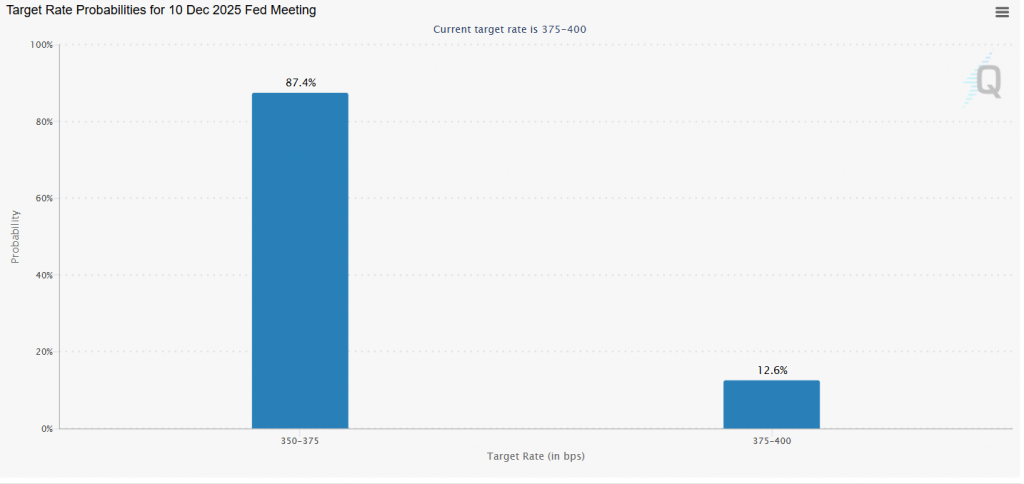

The Macro Catalyst: A 90% Chance of a Fed Rate Cut

The primary driver is clear: the market is front-running the Fed. CME’s FedWatch Tool shows a 87.5% probability of a 25-basis-point rate cut at tomorrow’s FOMC meeting. This expected shift toward easier monetary policy is a classic tailwind for cryptocurrencies, weakening the dollar and boosting the appeal of alternative, non-yielding assets. The rally suggests traders are positioning for a “dovish” outcome, anticipating that the Fed will signal a continued easing path into 2026.

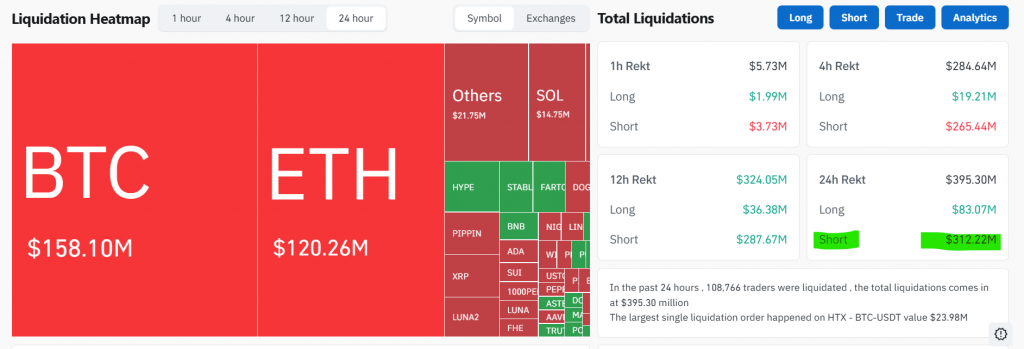

Market Mechanics: Short Squeeze Fuels the Move

The rally has been amplified by a forceful liquidation cascade. Over $390 million in positions were liquidated in just the last 24Hr, with a staggering 92% of those being short sellers. This massive forced buying (short squeeze) added rocket fuel to the upside move, clearing out pessimistic leverage and allowing the price to advance more freely. The timing is notable, as it follows a period of negative or low funding rates, indicating the market was under-leveraged and ripe for a squeeze.

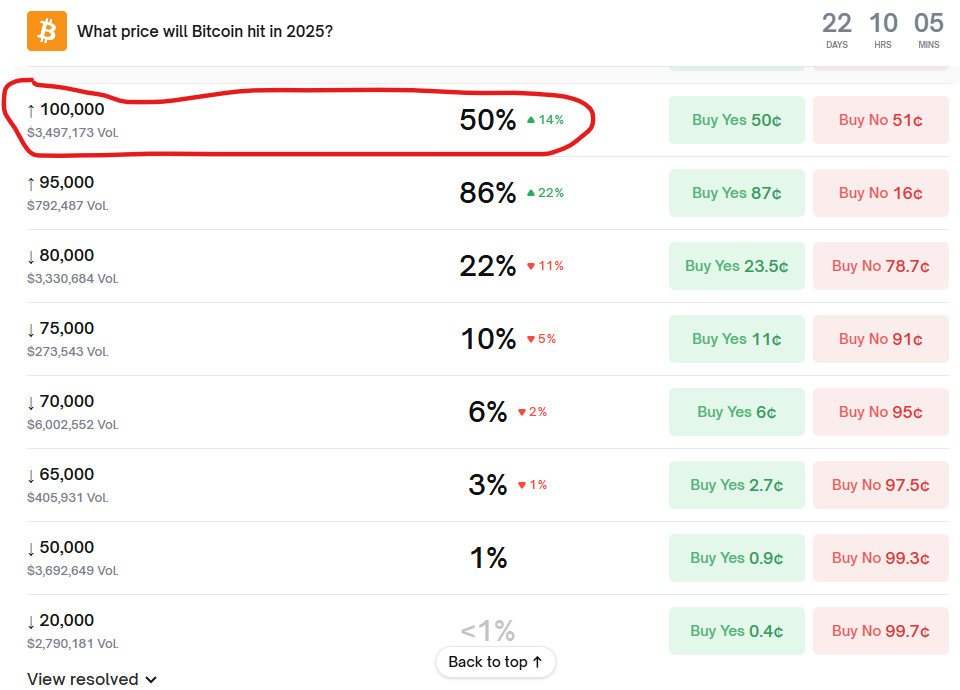

The “Santa Rally” Setup Gains Credibility

Institutional voices are growing bullish on the year-end setup. GSR’s Spencer Hallarn noted the recent crash to $83,000 “shook out many bulls,” creating a foundation of skepticism that often marks healthier rally beginnings. With leverage now flushed out and macro conditions turning favorable, the potential for a sustained crypto market rally into year-end—a “Santa Rally”—is increasing. This is echoed by prediction markets, where traders now see a 50% chance Bitcoin hits $100,000 before January.

Additional Tailwinds: CFTC Embraces Crypto as Collateral

Adding to the positive momentum, the CFTC launched a pilot program allowing the use of Bitcoin, Ethereum, and USDC as collateral in the derivatives market. This landmark move grants crypto assets formal utility within the regulated financial system, boosting their institutional legitimacy and long-term demand profile.

My Thoughts

This is a classic “sell the rumor, buy the news” setup playing out in reverse. The market is buying ahead of the expected news, anticipating that the Fed’s action will validate the move. The combination of a dovish macro shift, a brutal short squeeze, and structural regulatory progress (CFTC) creates a powerful bullish confluence. If the Fed delivers the cut without a hawkish surprise, the path of least resistance is firmly upward, with the $100,000 Bitcoin target firmly in play for December.