The crypto rally fades after a brief recovery, triggering $662M in liquidations despite strong ETF inflows. Market sentiment drops to “extreme fear” ahead of key economic data.

Crypto Rally Fades

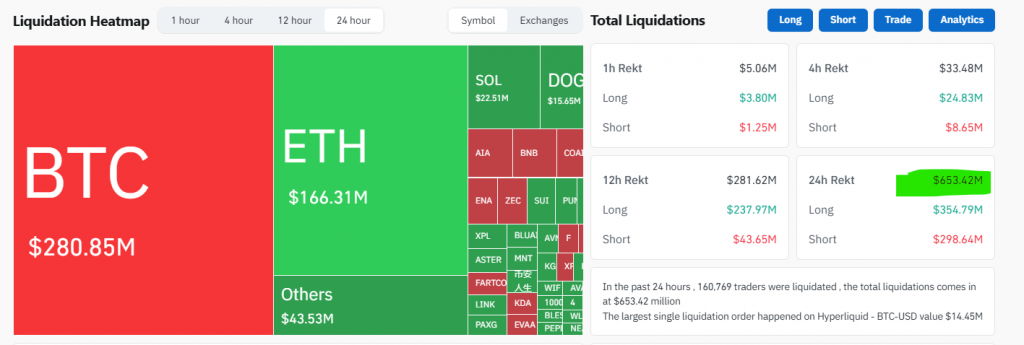

A promising crypto rally fades almost as quickly as it began, leaving traders with heavy losses and renewed uncertainty. What started as a strong recovery on October 21—with Bitcoin surpassing $113,000 and Ethereum reclaiming $4,000—completely reversed course by the next morning. The failed breakout triggered a massive $653 million in liquidations, marking one of the largest single-day wipeouts this month.

The data reveals a market trapped between hope and fear. While prices tumbled, overall open interest actually increased slightly, suggesting new positions are still being opened despite the volatility. This conflicting signal shows traders remain engaged but deeply divided on the market’s next direction.

Sentiment Sours as ETF Flows Provide Hope

The sharp reversal crushed market morale. The Crypto Fear & Greed Index plunged nine points to 25, solidifying “extreme fear” among investors. The brief crypto rally fades demonstrated how quickly optimism can disappear in the current environment.

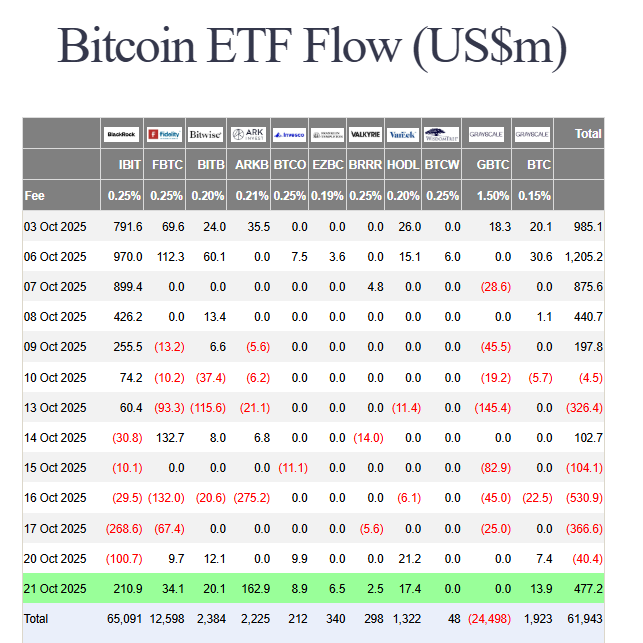

However, a crucial bright spot emerged beneath the surface. U.S. spot Bitcoin ETFs recorded $477 million in net inflows, decisively ending a four-day outflow streak. BlackRock’s IBIT led with $210 million, showing institutions used the dip to accumulate. Ethereum ETFs also saw $141 million return, suggesting smart money hasn’t abandoned the market.

Key Levels and What’s Next

As the crypto rally fades, critical support levels are being tested. Bitcoin now battles to hold $108,500 while Ethereum struggles at $3,850. All eyes turn to the October 24 U.S. inflation report and the Federal Reserve’s meeting later this month, which will heavily influence whether liquidity conditions improve.

The Altcoin Season Index’s modest rise to 29 offers a glimmer of hope—it suggests altcoins may be building relative strength against Bitcoin, potentially setting the stage for a broader recovery once stability returns.

My Thoughts

This was a classic “bull trap” that liquidated over-optimistic longs. The positive ETF flows are the real story here—institutions are clearly still interested at these levels. The market needs to consolidate and build a stronger base before the next sustained upward move. If inflation data comes in cool, we could see this failed rally quickly forgotten.