The highly anticipated decision from the US Securities and Exchange Commission regarding a spot-Bitcoin exchange-traded fund took an unexpected turn, becoming a significant cybersecurity incident on Tuesday.

The SEC’s official account, X, was compromised, leading to a false announcement claiming the agency had given the green light for these products. This misinformation caused a brief surge in the price of Bitcoin, prompting US authorities to launch an investigation into the breach of the social media account held by Wall Street’s primary regulator.

Kurt Gottschall, a partner at law firm Haynes Boone and former SEC regional director, highlighted the broader implications: “This incident truly demonstrates the widespread and frequent nature of cyberattacks.” The irony wasn’t lost on observers, considering the SEC’s history of holding public companies accountable for cybersecurity incidents, while now facing its own breach.

For supporters of cryptocurrency, this breach added weight to their longstanding distrust of the SEC’s chair, Gary Gensler, known for his efforts to regulate the industry. The irony of a cybersecurity incident hitting a regulator that consistently warned about crypto’s vulnerabilities wasn’t lost on critics eagerly awaiting the SEC’s approval of a Bitcoin ETF. Speculation had been ripe that the agency might approve several such products soon.

The SEC swiftly announced plans to collaborate with law enforcement for a thorough investigation, clarifying that the false post didn’t originate from the agency or its staff. Gensler emphasized that no decision had been made regarding ETFs.

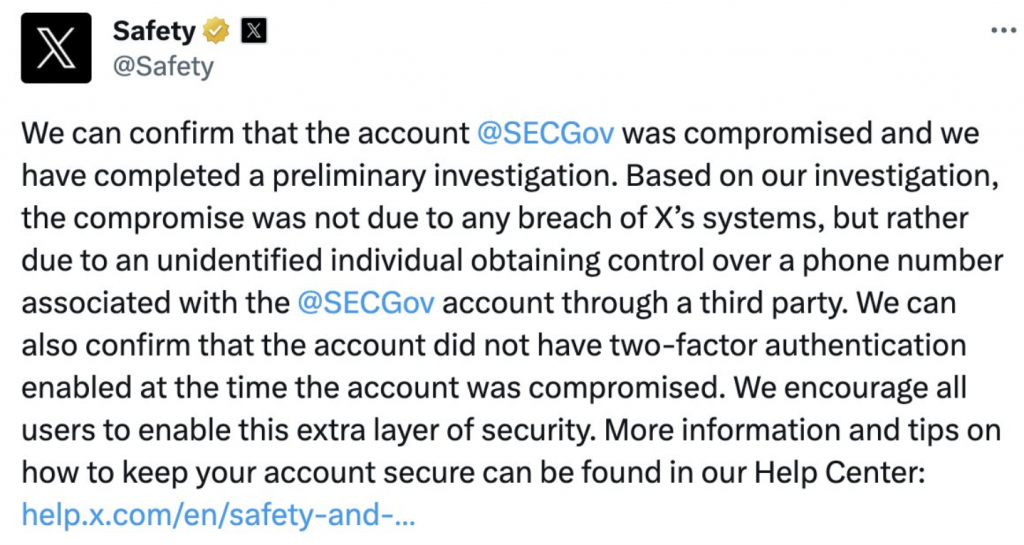

The breach occurred due to unauthorized access to the @SECGov X account, which was swiftly terminated after the false post. Joe Benarroch, head of business operations at X, assured that investigations into the root cause were underway, confirming the account’s security.

It was revealed that the breach resulted from an individual gaining control of a linked phone number, exploiting the absence of two-factor authentication, an additional security layer increasingly crucial in thwarting cyberattacks.

Republican Senators JD Vance and Thom Tillis demanded explanations for the “errant” post, seeking a briefing from the SEC by January 23.

Regarding the pending decision on ETFs, the SEC had until January 10 to act on one of the applications. Speculation suggested a potential simultaneous announcement of multiple decisions by the regulator.

For a spot-backed Bitcoin ETF to commence trading, the SEC needed to approve 19b-4 filings by the exchanges and S-1 forms from issuers like BlackRock Inc. and Fidelity. Reports indicated the SEC’s plan to vote on the exchanges’ filings this week, with the possibility of action on the issuers’ applications around the same time, paving the way for ETF trading.

The SEC, under both Gensler and his predecessor Jay Clayton, had previously withheld approval for such products, citing investor protection concerns and fears of market manipulation. However, growing pressure post a legal setback against Grayscale Investments in August indicated a potential shift in the SEC’s stance.

Speculation around ETF approval has led to heightened excitement on social media, triggering significant market movements, such as a 10% surge in Bitcoin in October, fueled by false information about BlackRock’s approval for a spot ETF. This surge led to the liquidation of approximately $85 million worth of mostly bearish trading positions before quickly reversing course.