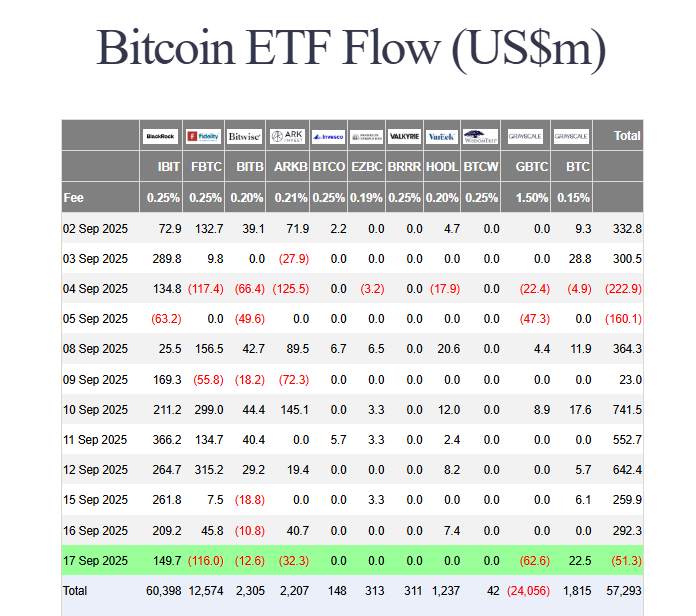

The impressive inflow streak for Spot Bitcoin ETFs has finally ended. On Wednesday, these funds experienced net outflows of $51.28 million, breaking a seven-day run that had brought in nearly $3 billion.

This shift in investor sentiment appears to be a direct reaction to the Federal Reserve’s unexpectedly cautious stance on future interest rate cuts.

Why the Sudden Shift?

The Fed meeting delivered a classic case of “buy the rumor, sell the news.” While the central bank did cut its benchmark rate by 25 basis points as expected, its updated economic projections surprised markets.

The Fed’s “dot plot” now indicates only two more cuts in 2025, which is fewer than traders had hoped for. During his press conference, Chair Jerome Powell struck a cautious tone, warning of “elevated” inflation and rising “downside risks” to employment.

Markets interpreted this as a “hawkish cut,” meaning the rate cut was overshadowed by a promise to keep policy restrictive for longer. This naturally made investors more wary of risk-on assets like Bitcoin.

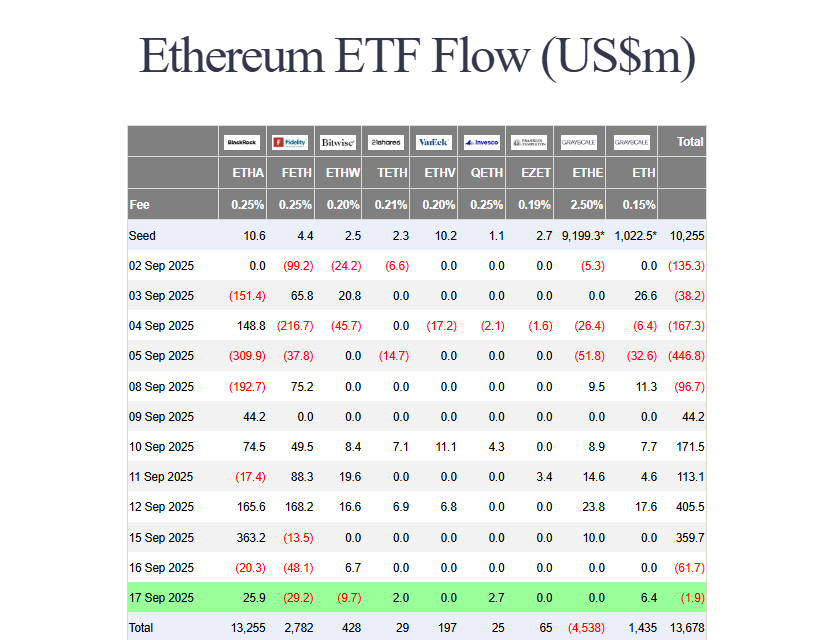

Ethereum ETFs saw Outflows

The outflows weren’t limited to Bitcoin. Spot Ethereum ETFs also saw redemptions for a second consecutive day. Withdrawals amounted to $1.89 million, following a larger outflow of $61.7 million the day before.

This indicates that the cautious mood is affecting the broader crypto ETF landscape.

A Silver Lining for Crypto Prices

Despite the ETF outflows, cryptocurrency prices themselves held up surprisingly well. Bitcoin (BTC) managed a 0.3% gain over 24 hours, while Ether (ETH) climbed 1.7%.

The broader even posted a solid 2% gain. This resilience suggests that while short-term ETF flows can be reactive, the underlying market structure for crypto remains strong.

The key takeaway is that the long-term narrative for Bitcoin remains intact. This outflow is likely a short-term recalibration by traders, not a signal of a larger trend reversal.