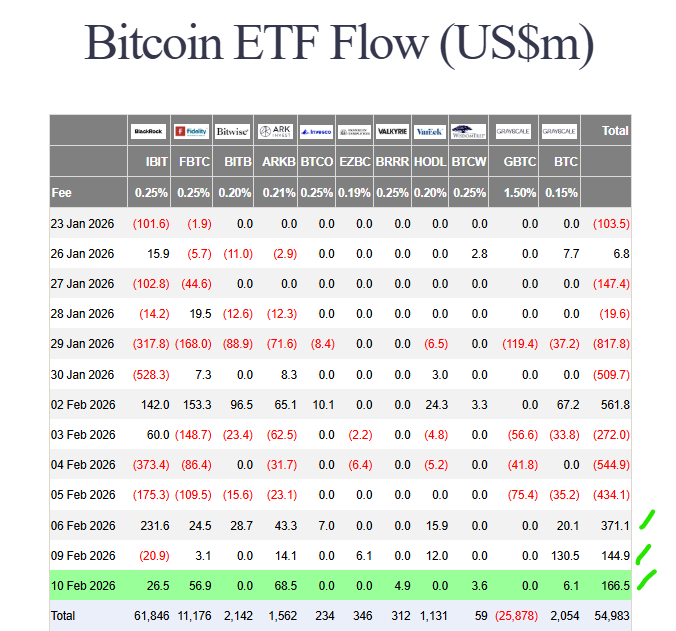

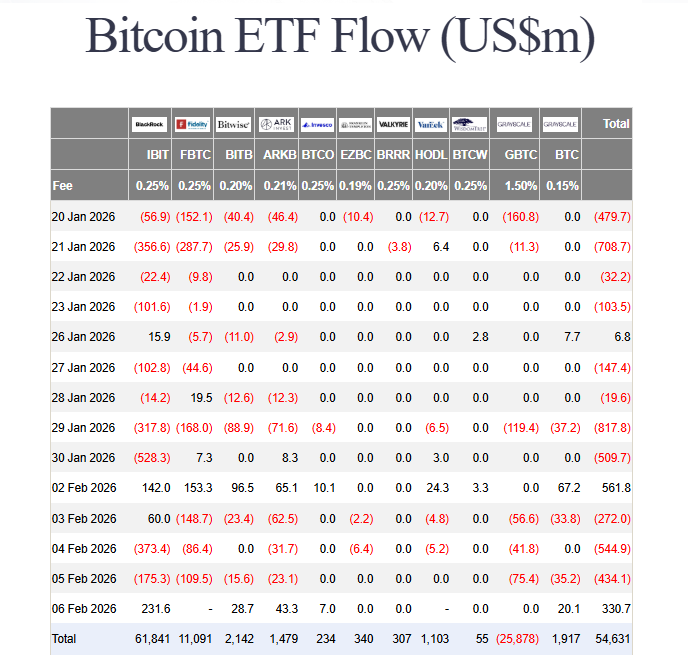

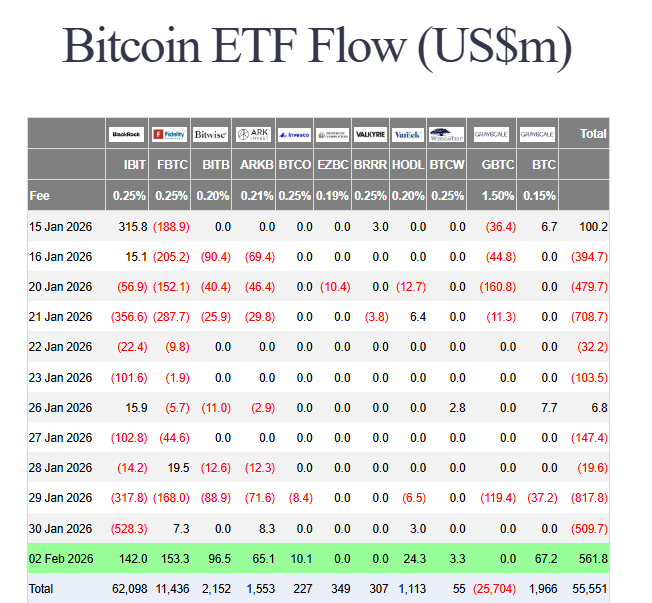

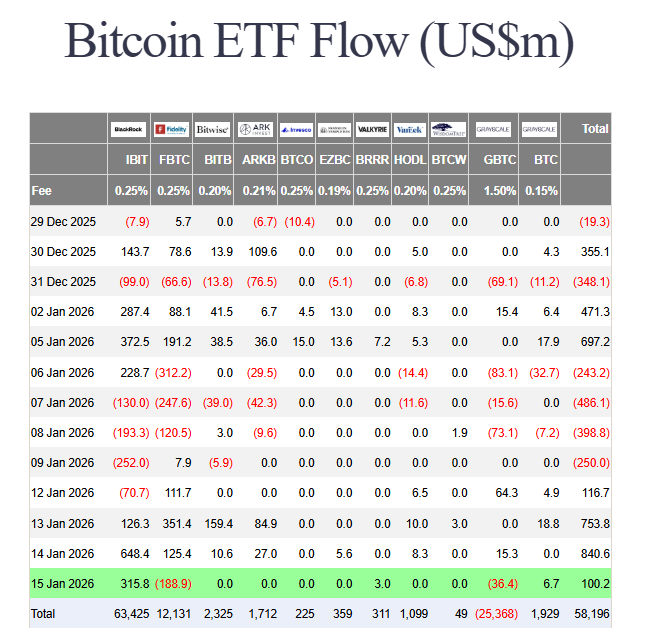

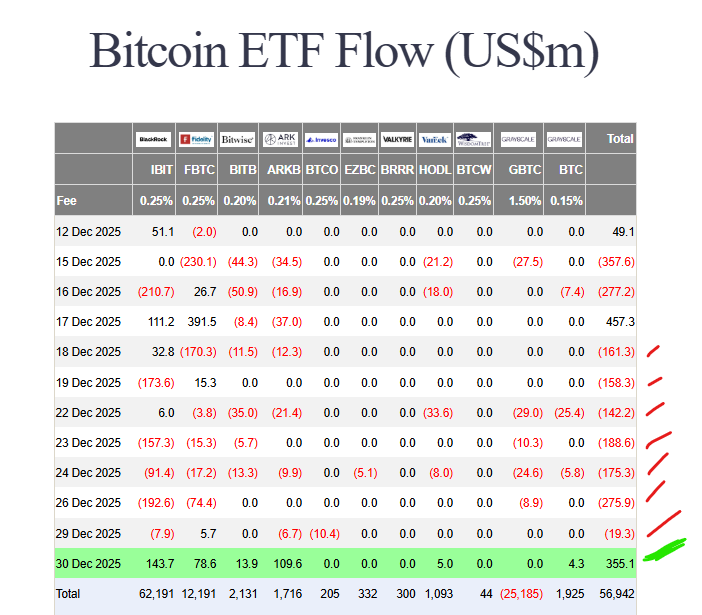

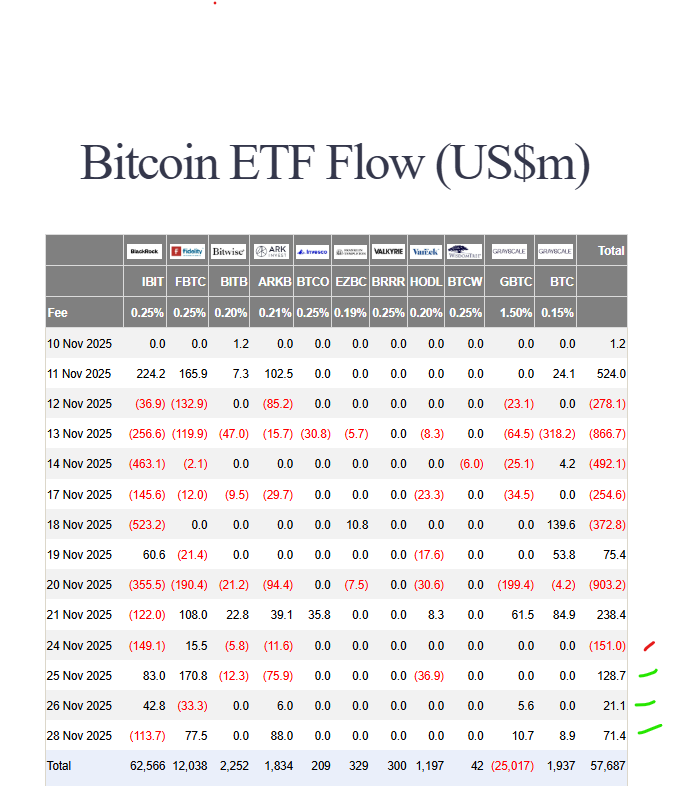

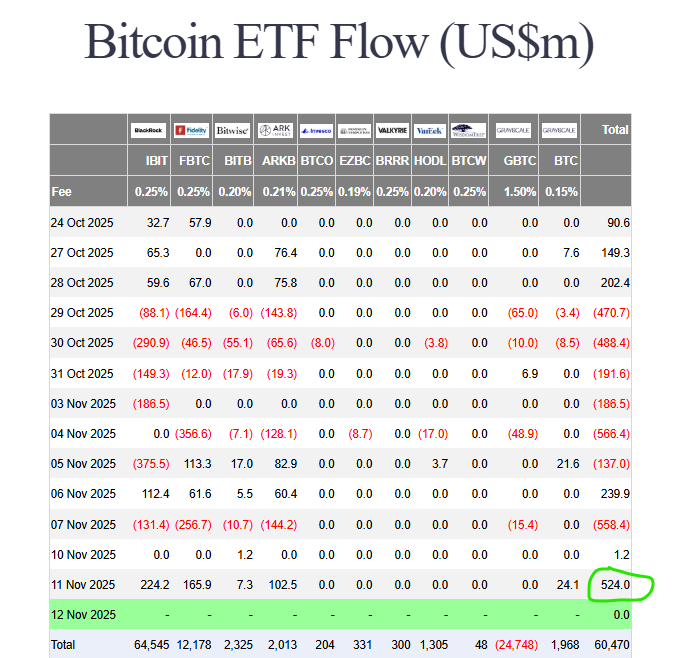

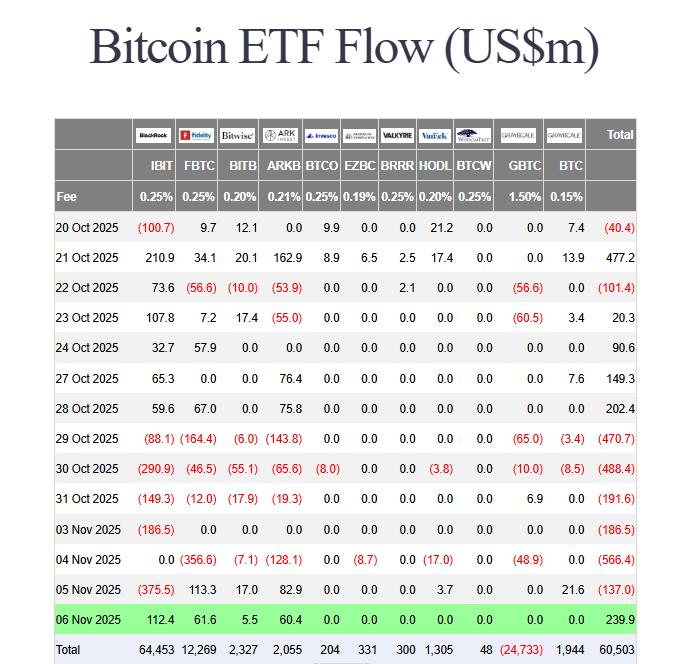

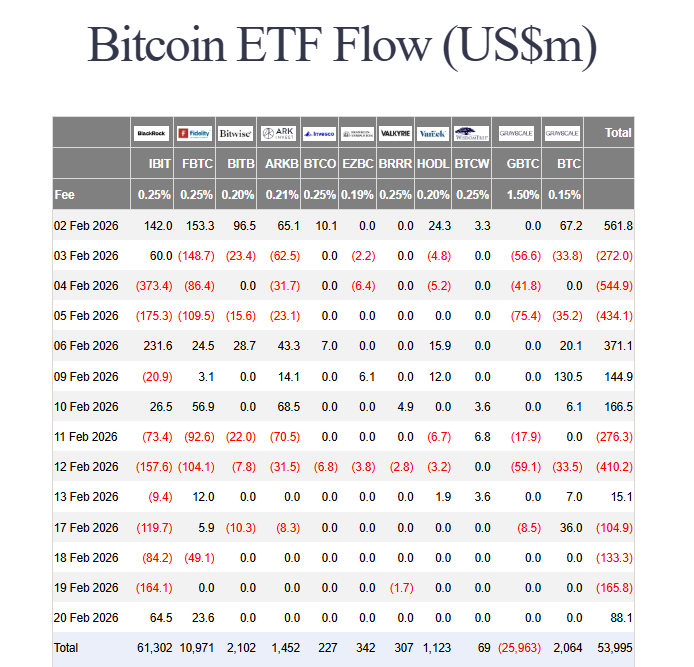

The bleeding has stopped—for now. Bitcoin ETF inflows returned on February 20 with $88.04 million, breaking a three-day outflow streak that had drained $403.90 million from the products. BlackRock’s IBIT led the charge with $64.46 million, while Fidelity’s FBTC added $23.59 million. All other funds recorded zero flows for the session.

Bitcoin ETF Inflows Return: The Data

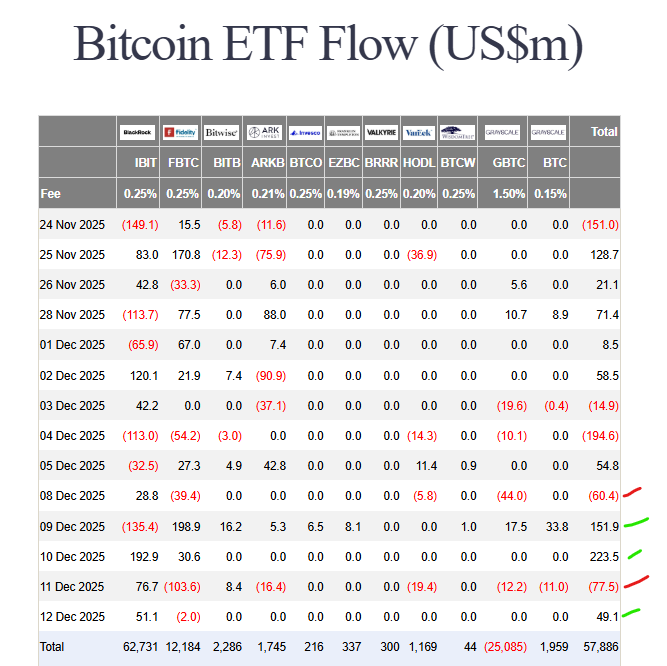

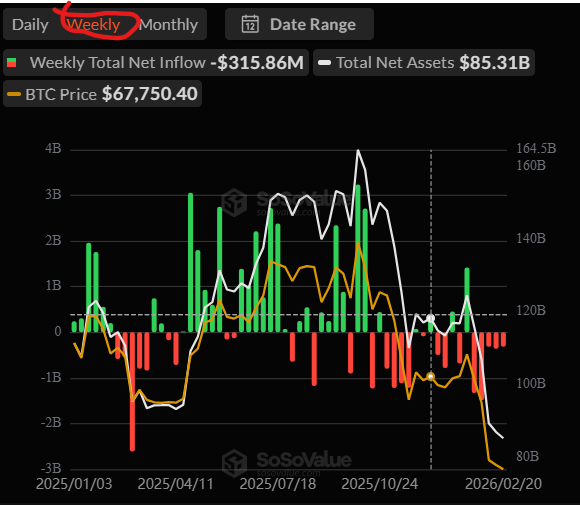

The reversal follows a brutal stretch. February 17-19 saw consecutive redemptions, peaking with $165.76 million on February 19. Total net assets had slipped from $87.04 billion on February 13 to $85.31 billion before yesterday’s inflows provided relief.

Bitcoin itself showed minimal reaction, trading near $67,800 after touching a low of $66,452 during the session. The 24-hour range remains tight as markets digest macro uncertainty.

The Bigger Picture: Four Weeks of Pain

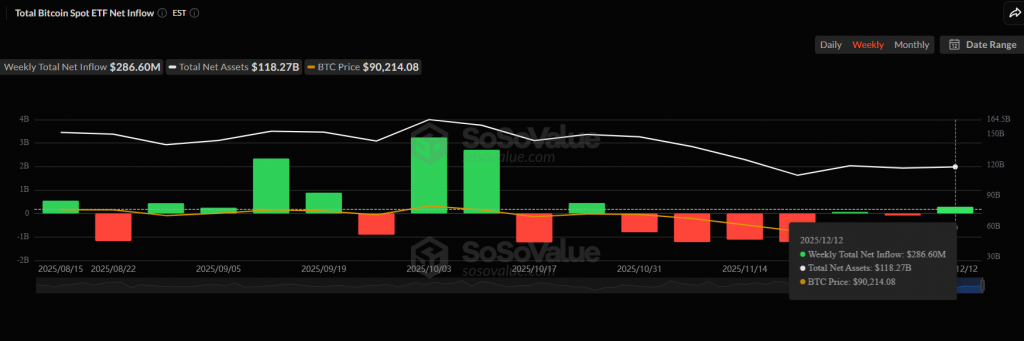

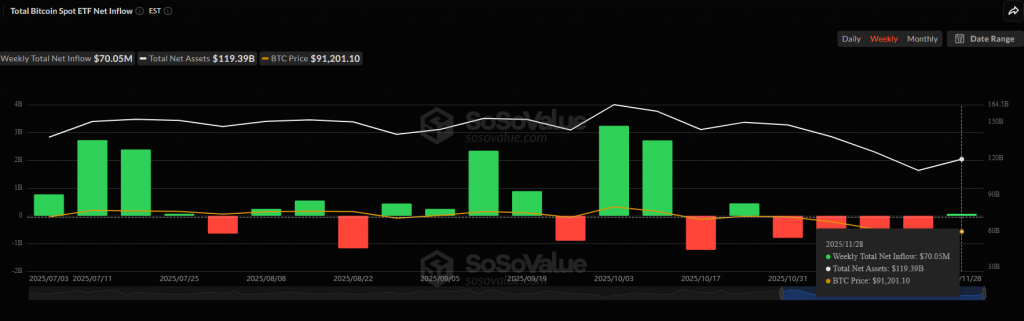

Despite yesterday’s positive print, the weekly picture remains ugly. The week ending February 20 posted $315.86 million in net outflows—the fourth consecutive weekly redemption period. The four-week stretch from January 23 through February 20 has drained approximately $2.48 billion from Bitcoin ETFs.

Weekly trading volume has also collapsed to $11.91 billion, down from $18.91 billion the prior week, signaling declining participation.

My Thoughts

One swallow does not make a summer. Yesterday’s Bitcoin ETF inflows are welcome, but they don’t erase the $2.48B exodus of the past month. The fact that only two products saw activity—while a dozen others sat at zero—suggests concentrated, not broad-based, demand.

That said, the streak break is psychologically important. It proves buyers exist at these levels. The next critical test is whether this becomes a sustained trend or just a dead-cat bounce in flow data.

For traders, watch Friday’s numbers closely. A second consecutive inflow day would signal potential trend reversal. Another flat-to-negative day confirms the bearish flow regime remains intact.