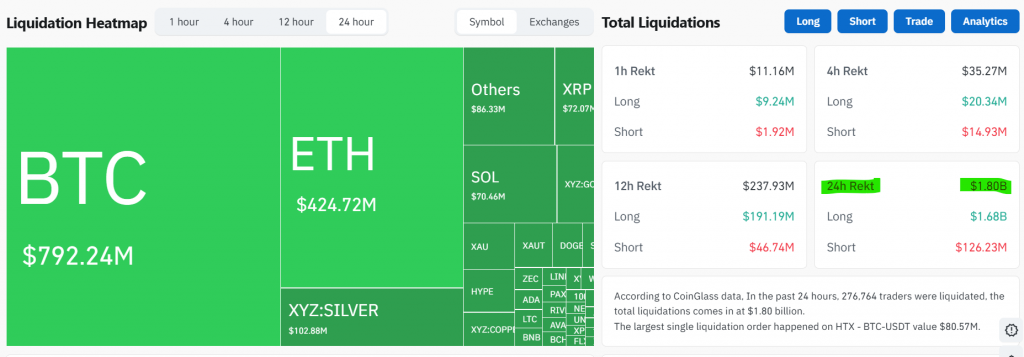

The dam has broken. Bitcoin has decisively sliced through the critical $84,000 support level that held firm since November 2025, plunging to two-month lows near $81,000. This sharp Bitcoin price drop has triggered over $1.6 billion in market-wide long liquidations and unleashed a wave of extreme fear. Now, analysts are mapping out a path that could see far deeper declines if bulls fail to regain control.

Analyzing the Severity of the Bitcoin Price Drop

This isn’t a routine pullback. Bitcoin breached multiple key defenses: the 2026 yearly open at $87,000, the 100-day moving average, and the crucial $84K-$86K demand zone. The Crypto Fear & Greed Index has cratered to a reading of 16—Extreme Fear. This level of sentiment often coincides with major capitulation events and suggests a significant shift in market structure.

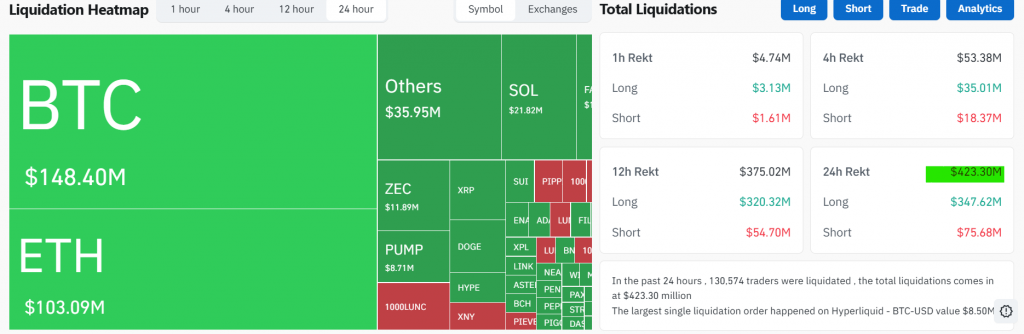

The liquidation cascade, with over $792 million from BTC positions alone, indicates that leveraged optimism has been thoroughly flushed. Economist Timothy Peterson notes that broader consumer sentiment is at record lows, creating an environment where risk assets like Bitcoin struggle to find bids. “There’s no upcycle until this reverses,” he stated.

Where Could Bitcoin Bottom?

The analysis grows sobering from here. Several respected traders are now looking at a prolonged bear scenario. Targets include a retest of the 200-week moving average (currently near $58,000) and even the 2021 all-time high near $69,000 as potential resistance-turned-support.

Analyst Keith Alan draws parallels to the 2021-2022 cycle, suggesting the bear market may last longer than many hope. His worst-case projection sees Bitcoin eventually exploring the $50,000 range later in the year, especially if the decline accelerates rapidly in the coming weeks.

My Thoughts

This is the moment that separates tourists from natives. While the $50K call is a worst-case scenario, the break of $84K is undeniably bearish in the short term. However, extreme fear is where long-term foundations are built. This flush is necessary to remove weak leverage and set the stage for the next cycle. My strategy? Scale in patiently, focus on the 200-week MA as a high-conviction accumulation zone, and remember that these depths of despair have preceded every historic Bitcoin rally.