Bitcoin Price Surge Past $90,000: Here’s What’s Fueling the Rally

Bitcoin just blasted through the $91,000 barrier in a stunning move that has the entire market buzzing. This isn’t random noise; it’s a direct reaction to two seismic shifts in traditional finance. The rally signals a massive influx of fresh liquidity and investor demand, fundamentally changing the game.

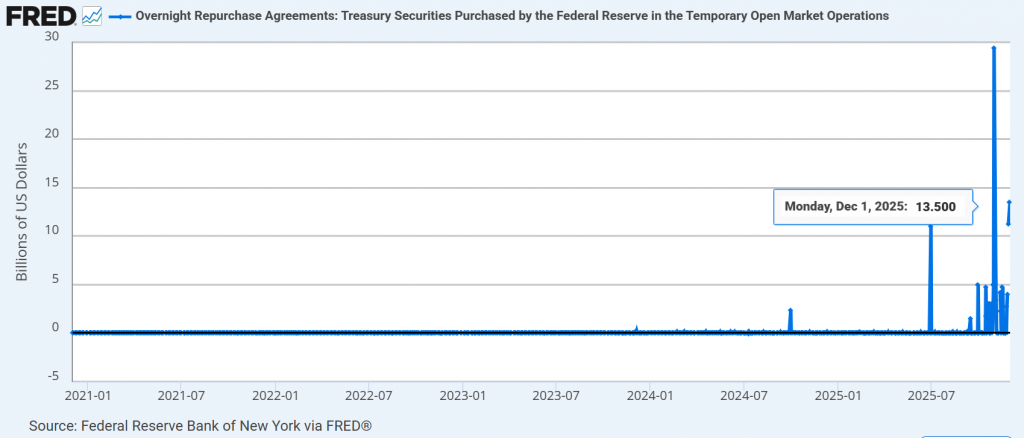

The Fed’s Pivot: Rocket Fuel for Liquidity

The primary catalyst is the Federal Reserve’s decision to end Quantitative Tightening (QT). Essentially, the Fed is stopping its withdrawal of money from the economy. This reversal removes a major pressure on global liquidity. Furthermore, the immediate injection of $13.5 billion acts like rocket fuel for risk assets. Bitcoin, as a leading alternative asset, is the first and biggest beneficiary. This move confirms that macro policy is now a tailwind, not a headwind.

The Vanguard Effect: A Historic Floodgate Opens

Meanwhile, the “Vanguard Effect” is in full force. When the investing giant announced it would allow trading of spot Bitcoin ETFs, it opened the gates for millions of conservative, mainstream investors. Analyst Eric Balchunas perfectly named the result. Bitcoin jumped 6% precisely at the U.S. market open on Vanguard’s first trading day. This surge reflects pent-up demand from a massive, previously excluded investor base. It’s a structural change bringing permanent new capital.

Liquidations and The Road to New ATHs

This explosive Bitcoin price surge has wreaked havoc on skeptics. Over $152 million in short positions were liquidated as BTC crossed $91,000, creating a powerful compounding effect. Now, with rate cut odds for 2025 soaring, the environment is set for sustained inflows. Analysts like Tom Lee see this momentum catapulting Bitcoin to a new all-time high potentially by January. The market is repricing for a full easing cycle from the Fed.

My Thoughts

This is a classic example of converging catalysts creating a parabolic move. We have a perfect storm: supportive macro policy meeting explosive new demand channels. The Vanguard move is arguably the most significant development for ETF accessibility yet. This rally feels fundamentally different; it’s driven by institutional and mainstream adoption, not just speculative frenzy. The path to $100,000 is now clearly in view.