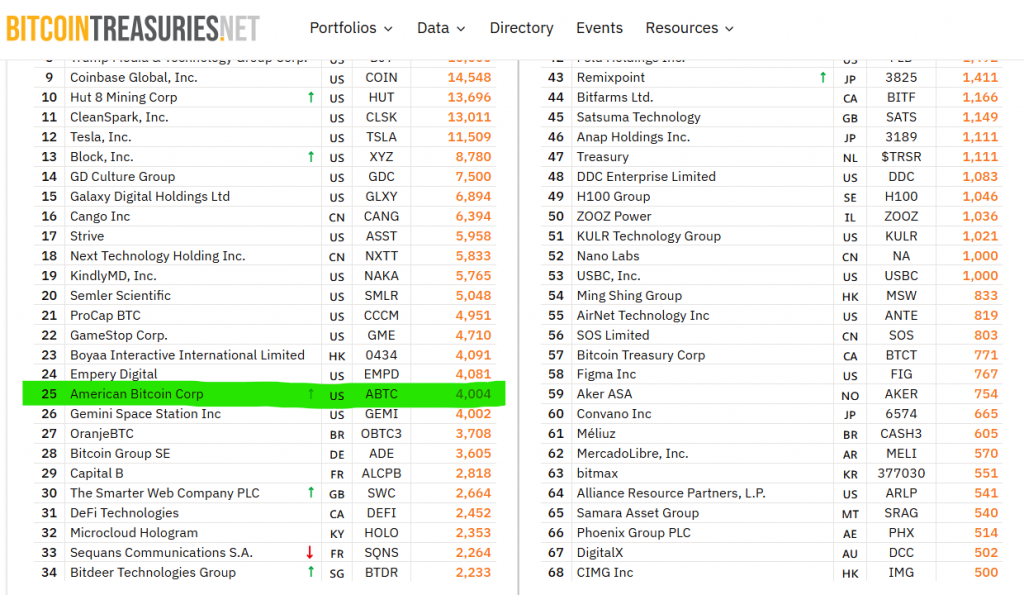

Another public company is loading the Bitcoin boat! The American Bitcoin Corp has officially revealed a strategic treasury holding of 4,004 BTC, cementing its position among the growing list of corporate giants embracing Bitcoin as a reserve asset.

American Bitcoin Corp. Joins Corporate Elite with 4,004 BTC Treasury

The Nasdaq-listed firm added 139 BTC in just 12 days through a powerful dual strategy of scaled mining operations and disciplined market purchases. This aggressive accumulation showcases a deep conviction in Bitcoin’s long-term value proposition, even amidst recent market volatility.

The Dual-Pronged Strategy: Mining and Buying

So, how is the American Bitcoin Corp building its stash so efficiently? The company employs a clever two-part strategy. First, it operates scaled mining operations, which generate a steady, cost-effective stream of new Bitcoin. Second, it supplements this organic production with strategic at-market purchases. Co-founder Eric Trump emphasized that this approach allows them to “expand Bitcoin holdings rapidly and cost-effectively.” This method provides a natural hedge, as mining profitability and asset price often move in tandem, creating a virtuous cycle of accumulation.

Transparency Through the Satoshis Per Share (SPS) Metric

Here’s a unique alpha for investors: the American Bitcoin Corp is pioneering transparency with its “Satoshis Per Share” (SPS) metric. This figure, now standing at 432, directly links each share of common stock to a specific amount of the underlying Bitcoin treasury. It’s a brilliant move that allows equity investors to clearly understand their exact exposure to the company’s Bitcoin holdings. This level of clarity is becoming a new standard for crypto-native public companies and provides a compelling reason to own the stock beyond mere speculation.

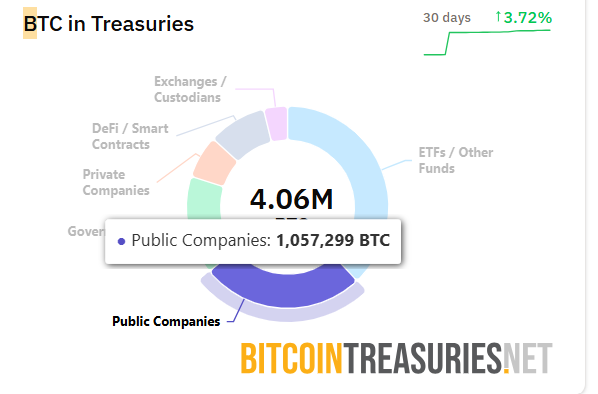

The Bigger Picture: A Growing Corporate Trend

The American Bitcoin Corp is far from alone. Data from bitcoin treasuries shows that 124 institutions Public traded companies now collectively hold a staggering 1.57 million BTC, worth $106 billion. This represents nearly 8% of Bitcoin’s entire supply. This massive corporate absorption is creating a structural supply shock, where a shrinking amount of BTC is available on the open market. As more companies adopt this strategy, the upward pressure on Bitcoin’s price from simple supply and demand dynamics could become immense.

My Thoughts

This is a masterclass in modern corporate treasury management. By combining mining with direct purchases, the American Bitcoin Corp is effectively dollar-cost averaging into Bitcoin with a built-in revenue stream. The SPS metric is a game-changer for investor relations. As this trend continues, the available liquid supply of Bitcoin will keep shrinking, setting the stage for explosive price appreciation in the next cycle. Every public company that follows this blueprint makes Bitcoin more scarce for everyone else.