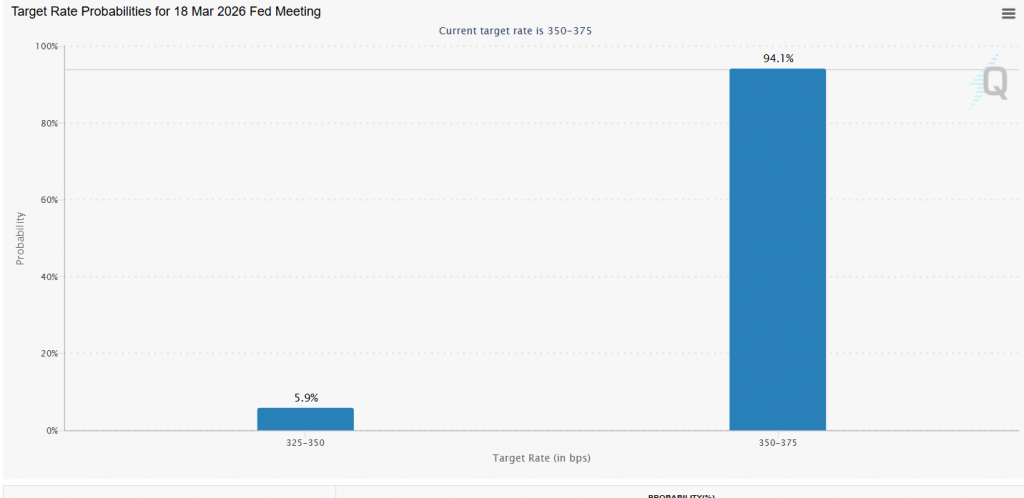

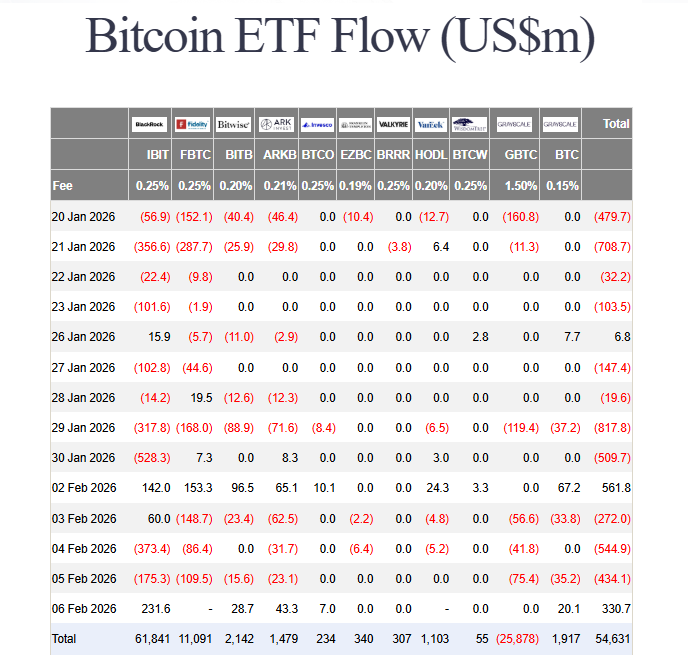

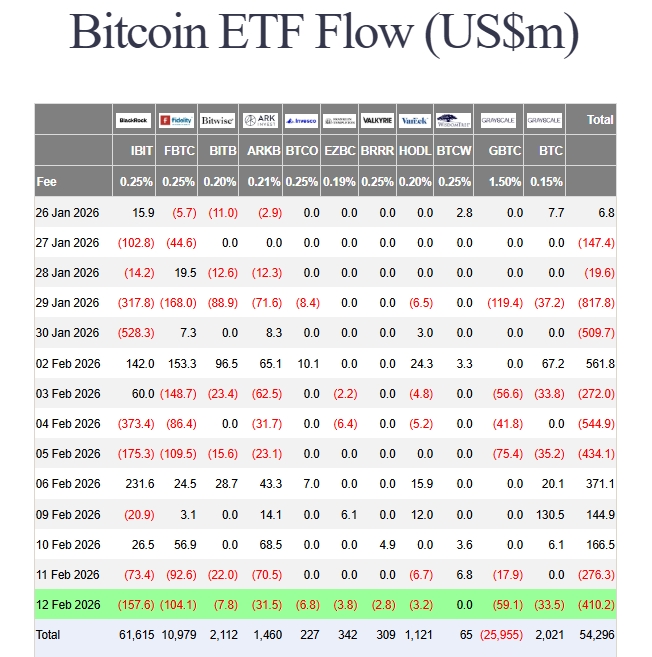

The institutional exodus is accelerating. Bitcoin ETF outflows surged to $410.4 million on Thursday, extending weekly losses to $375.1 million. Unless Friday delivers a miracle reversal, these funds are staring down a fourth consecutive week of redemptions. Assets under management are now hovering near $80 billion, a dramatic fall from the $170 billion peak in October 2025.

Bitcoin ETF outflows Source : Farside InvestorsStandard Chartered Adds Fuel to the Fire

The selling wave coincided with a major forecast revision from Standard Chartered. The bank slashed its 2026 Bitcoin target from $150,000 to $100,000, warning that prices could first capitulate to $50,000 before recovering. Ether’s outlook was similarly downgraded, with a $1,400 bottom predicted before a year-end rebound to $4,000.

This isn’t blind pessimism. CryptoQuant data confirms the realized price support sits near $55,000, a level that has not yet been tested this cycle. Importantly, while the market is in a “bear phase,” it has not yet entered the “extreme bear” regime that historically marks durable bottoms.

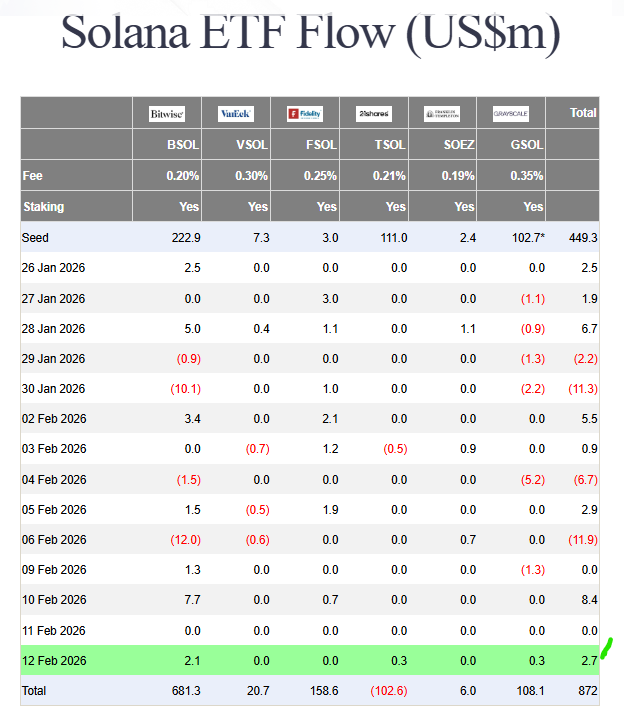

Solana ETFs Defy the Trend

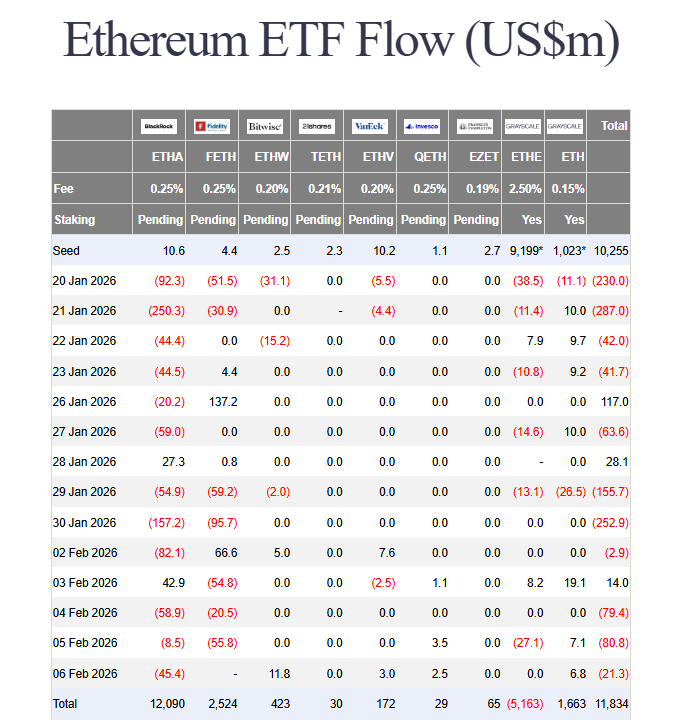

Not every product bled. Solana ETFs posted $2.7 million in inflows, making them the sole winners on a brutal day. Meanwhile, Ether ETFs lost $113.1 million, and XRP ETFs saw their first outflows since February 3.

Long-term holder behavior offers a sliver of context: they are currently selling near breakeven, not at the 30-40% losses that have marked historical bear market capitulation. This suggests the reset may not yet be complete.

My Thoughts

This is the ugliest stretch for Bitcoin ETFs since launch. Persistent Bitcoin ETF outflows tell a clear story: institutional risk appetite is gone. But here’s the nuance—Standard Chartered’s $50K floor aligns almost perfectly with CryptoQuant’s $55K realized support. That zone represents the ultimate conviction line. If it holds, this sell-side wave will be remembered as the final washout before the next leg up. If it breaks, all bets are off. For now, capital preservation is king. Wait for realized support to be tested and defended before deploying fresh capital.