The streak continues. Michael Saylor has announced its eighth consecutive weekly Strategy Bitcoin purchase, acquiring 2,486 BTC for $168.4 million. This marks the company’s 99th Bitcoin purchase since adopting the asset for its corporate treasury in 2020. One more buy and they hit the century mark.

The timing? Interesting. This accumulation sprint is playing out against a backdrop of growing institutional anxiety over quantum computing’s potential threat to Bitcoin. Kevin O’Leary recently warned that institutions are hesitating to exceed 3% allocations until the quantum risk is resolved. Saylor’s response? Buy more. And build.

Strategy’s 99th Bitcoin Purchase: The Details

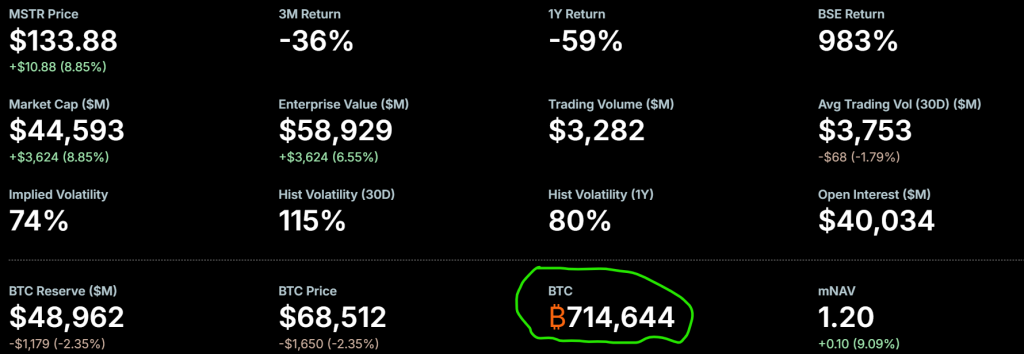

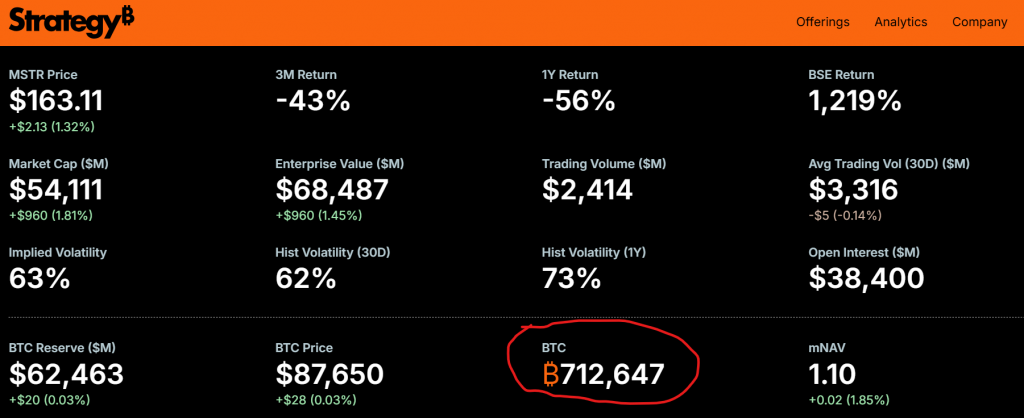

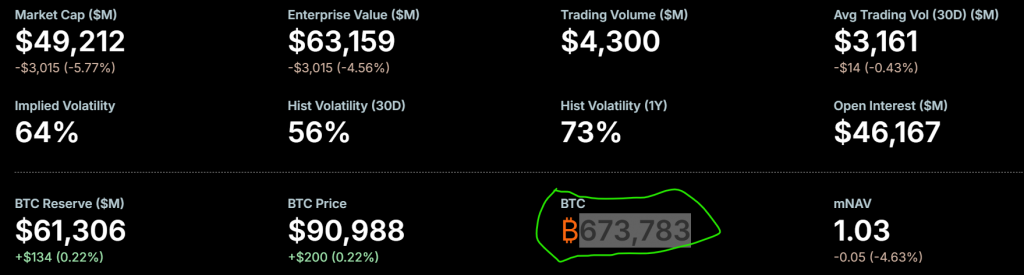

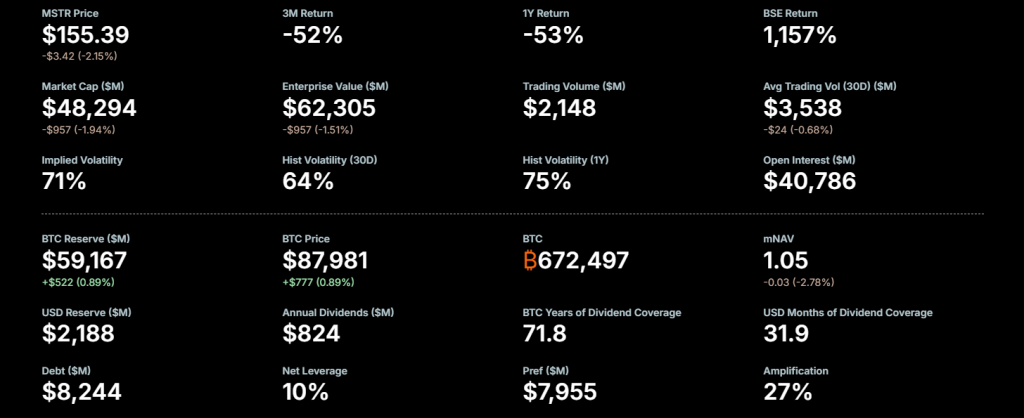

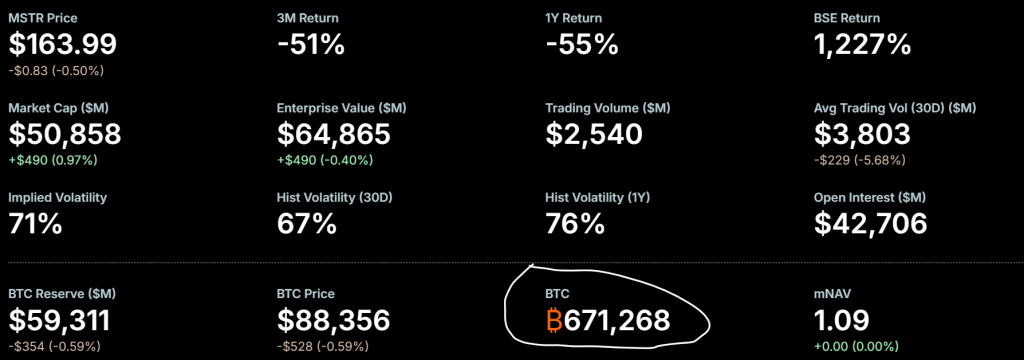

According to the SEC filing, Strategy acquired the BTC at an average price of $67,710 per coin, bringing total holdings to 717,131 BTC. Total acquisition cost now stands at $54.52 billion, with an average cost basis of $76,027 per Bitcoin.

Saylor teased the purchase with his customary Sunday X post—”99>98″—signaling this week’s buy exceeded last week’s. The message was clear: the accumulation algorithm remains unchanged.

Quantum Threat Meets Quantum Defense

The purchase comes as institutional investors openly voice quantum computing concerns. Kevin O’Leary warned of a potential Bitcoin crash if the threat materializes, noting institutions are “hesitating.”

Notably, during last week’s earnings call, Strategy launched a Bitcoin Security Program specifically designed to address quantum computing threats. The initiative aims to collaborate with the global cybersecurity community to develop quantum-resistant upgrades for Bitcoin.

Saylor himself has downplayed the immediacy, describing quantum computing as a concern “still likely years away” and part of recurring FUD Bitcoin has faced since inception. But the proactive move signals that Strategy is thinking in decades, not days.

My Thoughts

This is the purest expression of conviction in the face of emerging risk. While O’Leary and others cite quantum computing as a reason to pause, Saylor doubles down and builds a defense simultaneously.

The Strategy Bitcoin purchase streak is now a market signal in itself. Every Sunday, the market anticipates the filing. Every Monday, it arrives. This predictability creates a structural bid that compounds over time.

The quantum threat is real but distant. By launching a security program now, Strategy positions itself—and Bitcoin—as adaptive, not static. This is how you future-proof a treasury. This is how you lead.

For investors, the message is simple: fear is a reason to prepare, not to flee. Saylor is preparing. So should you.