Bitcoin is currently battling a major resistance wall at $115,892, failing to close above it in two recent sessions. While this short-term consolidation might seem concerning, a look under the hood reveals a powerfully bullish setup. Key on-chain metrics are flashing green, suggesting this pause might be the calm before a significant storm to the upside.

Key Bullish Signal #1: Record Network Growth

Despite the price hesitation, the Bitcoin network is experiencing unprecedented growth. Data from Glassnode shows the number of active wallets has surged to a year-to-date high.

- Non-Zero Wallets: 54.37 million addresses now hold some amount of BTC.

- What It Means: This metric measures active participation in the network. A rising count signals growing adoption from both retail and institutional investors, creating a strong fundamental base for a future price surge.

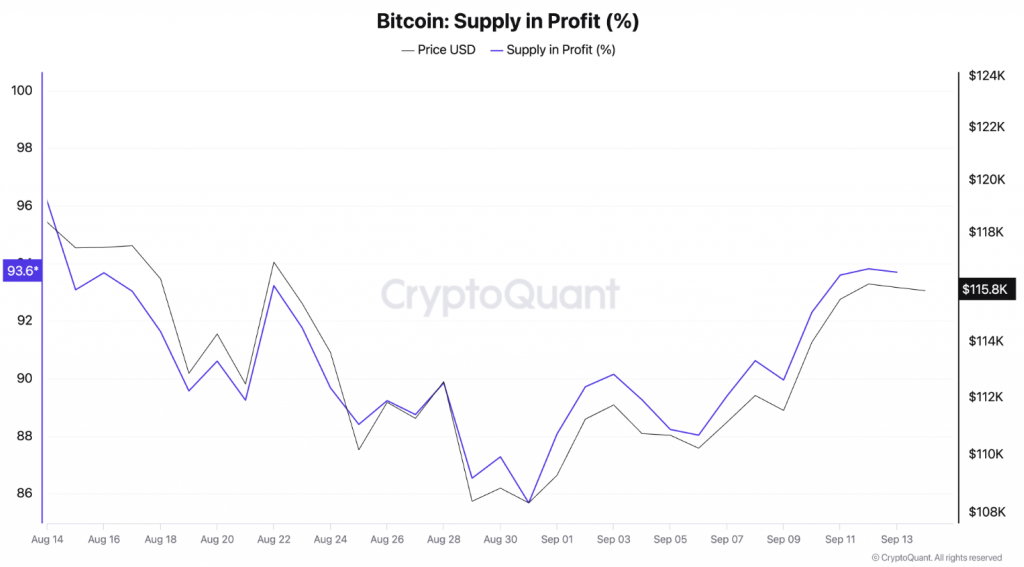

Key Bullish Signal #2: Nearly Everyone is in Profit

Perhaps the most stunning statistic is profitability. According to CryptoQuant, a whopping 93.6% of Bitcoin’s circulating supply is currently held at a profit.

- Historical Context: The long-term average for this metric is around 75%.

- Why It’s Bullish: As pseudonymous analyst Crypto Avails explained, this level of profitability is not a sign of a top but rather a sign of “strong optimism and sustained momentum” that has historically preceded major bullish phases.

Bitcoin Price Prediction: The Path Forward

The combination of record adoption and extreme profitability creates a compelling case for a breakout.

- Bullish Scenario: A decisive daily close above $115,892 could trigger a rally toward $119,367. If momentum continues, the next major target sits at $122,190.

- Bearish Scenario: If selling pressure intensifies, BTC could fall back to test support at $111,961. However, the strong on-chain fundamentals make a deep crash appear less likely.

The Bottom Line

While the price chart shows a short-term stalemate, the on-chain story tells of immense underlying strength. The record number of active wallets and near-universal profitability suggest that investors are holding with conviction, not selling. For traders, this consolidation below $116,000 may represent a prime accumulation zone before the next leg up in Bitcoin’s bull run. All it needs is a catalyst to break through.