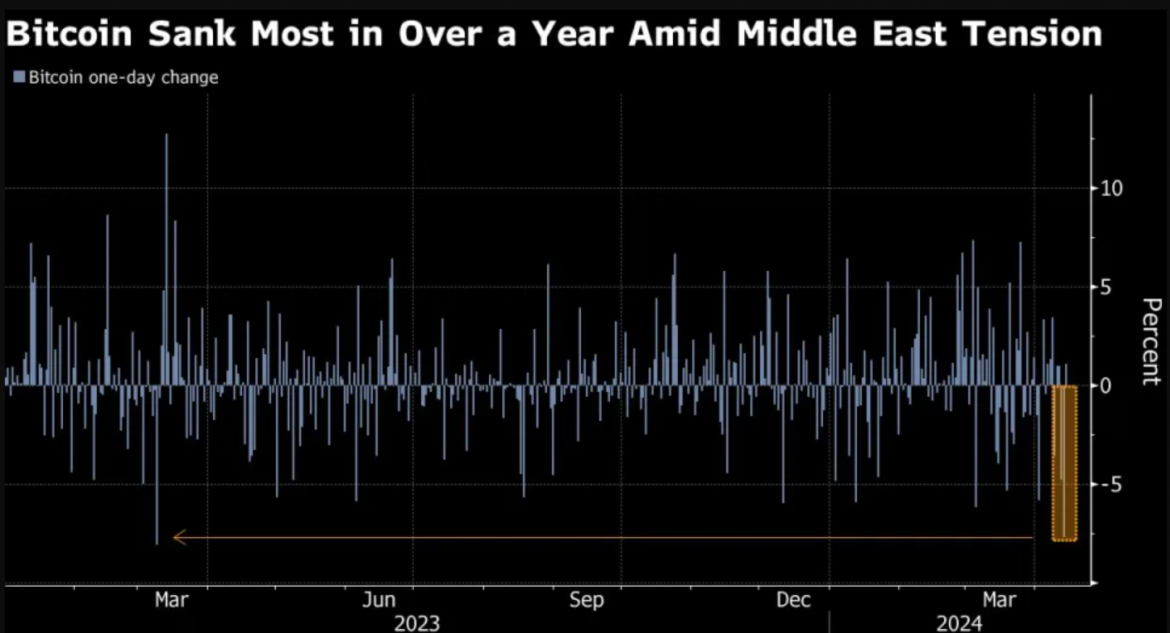

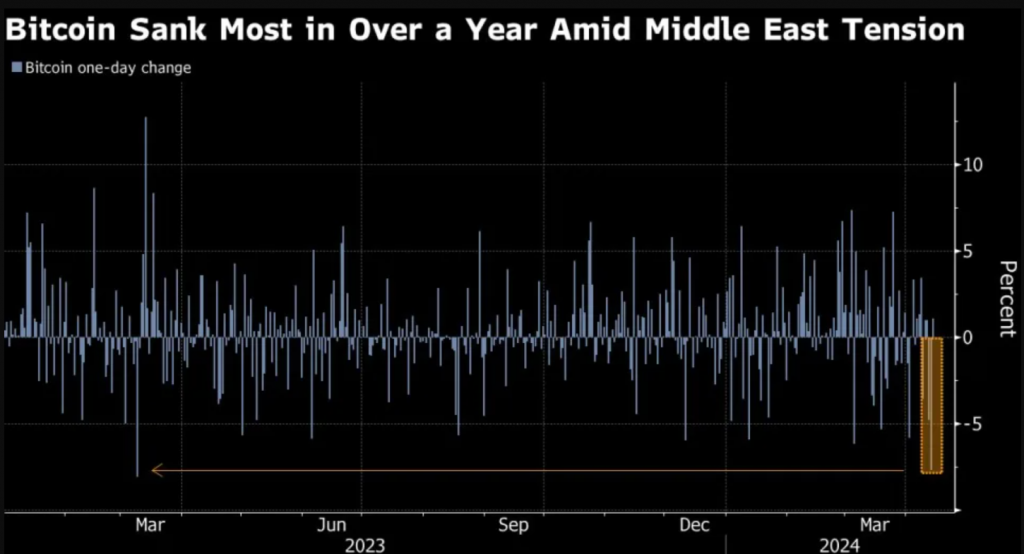

Bitcoin faced challenges gaining momentum following a significant drop, marking its most substantial decline in over a year. This decline was part of a broader slump across cryptocurrency markets, triggered by escalating geopolitical tensions in the Middle East, which prompted investors to lean towards safer assets.

On Saturday, the primary cryptocurrency experienced a 7.7% decrease, its most significant retreat since March 2023. However, it managed to recover slightly, trading at around $63,230 by Sunday morning in Singapore. Other major cryptocurrencies, including Ether, Solana, and the beloved Dogecoin among meme enthusiasts, also recorded losses over the past 24 hours.

The tension in the Middle East heightened as Iran launched drone and missile attacks against Israel, seemingly in retaliation for an earlier strike in Syria that resulted in the deaths of high-ranking Iranian military officials. With digital assets trading throughout the weekend, investors had a glimpse into the potential sentiment before traditional markets reopened on Monday, although circumstances could shift significantly by then.

According to Zaheer Ebtikar, founder of crypto fund Split Capital, the continuation of the crypto sell-off may depend on further escalations in geopolitical tensions. As investors brace for potential market movements on Monday, the impact of the ongoing conflict remains uncertain.

The escalating tension not only affected the cryptocurrency market but also influenced traditional markets, with stocks experiencing a decline on Friday while safe-haven assets like bonds and the dollar saw increased demand. Data from Coinglass revealed approximately $1.5 billion worth of bullish crypto positions via derivatives were liquidated over Friday and Saturday, marking one of the most substantial two-day liquidation events in at least six months.

Ebtikar noted that excessive leverage contributed to the significant price declines in digital assets over the past few days. Bitcoin has fallen roughly $10,000 from its mid-March peak of $73,798. Although the debut of dedicated US exchange-traded funds (ETFs) in January initially fueled demand and drove the token to an all-time high, recent net inflows into these products have tapered off.

Speculators in the cryptocurrency market are eagerly anticipating the Bitcoin halving, scheduled to reduce the token’s new supply by half, expected around April 20. Historically, halving events have boosted prices, but doubts are emerging about a repeat performance given Bitcoin’s recent historical peak.